Tags : Biofuels Hydropower Renewable Energy Solar Power Sustainable Wind Power

Introduction

Renewable Energy is an increasing factor in global energy production and consumption, with the industry having undergone record growth in the 2016-18 time period. In 2016, renewables experienced greater growth than any other fuel source, accounting for almost two-thirds of new power capacity additions around the world, and they have continued to lead the way on the growth front in the last two years. While the future of this market may be affected by the uncertainty caused by actual policy changes and pending policy updates, the renewable energy sector is poised to continue along this growth trajectory due to the existence of a number of trends that will maintain its upward momentum. These include trends associated with environmental friendliness, innovative technology advancements, growing energy demand, and declining costs & prices for wind and solar power, among others.

The fastest growing technologies in Renewable Energy are Solar PV and Wind, but additional segments such as Hydropower already play key roles, while other segments such as Concentrated Solar (CSP) & Geothermal are all growing in significance as the world strives to decarbonize its energy mix.

In this article, Daydream will give a brief introduction to the Global Renewable Energy market and how the company can add value to chemical & materials organizations that are looking to tap into this space. If you need more information regarding the Renewables space and related industries, please contact us.

MARKET OVERVIEW

According to a U.S. Energy Information Administration study, renewable energy will be the fastest global growing source for energy generation through 2040, growing at an average annual rate of 2.8%. The study goes on to predict that by 2040, more than 30% of global electricity will come from renewable sources.

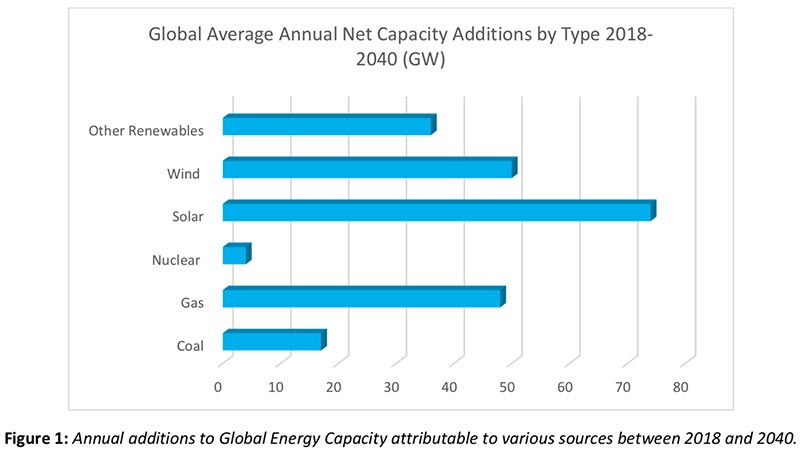

This tremendous growth will primarily be attributed to the booming Solar and Wind segments, as technical improvements and government incentives will make these technologies more and more cost competitive over time. Current projections forecast Global Wind energy consumption reaching 2.5 trillion kWh annually while the Solar sector will account for 1.4 trillion kWh Globally by 2040. Riding on the strength of Solar and Wind energy, the Renewables space is projected to add ~160 GW of capacity annually to the Global energy market through 2040, as can be seen in Figure 1 below.

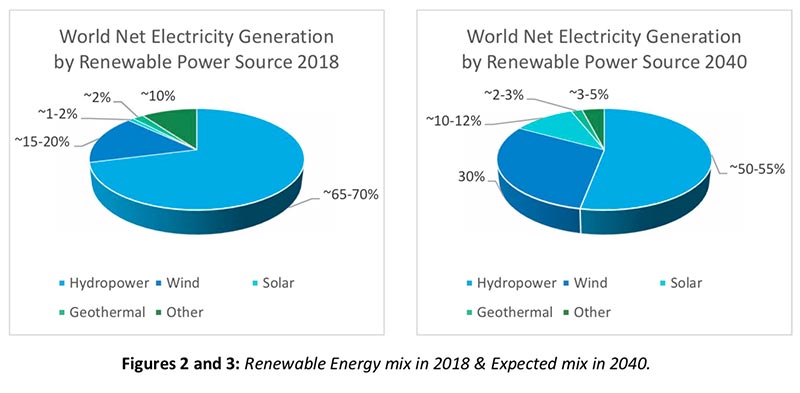

Much of the rise in market share of Solar and Wind power will come at the expense of Hydropower, the leading provider of electricity among renewable sources today. Hydropower’s share of the total renewable energy market will drop to circa ~50-55% in 2040, down from about 65-70% in 2018, as resource availability and environmental concerns in many countries limit the number of new hydropower projects. The changing landscape for Renewables is depicted in Figures 2 and 3 below.

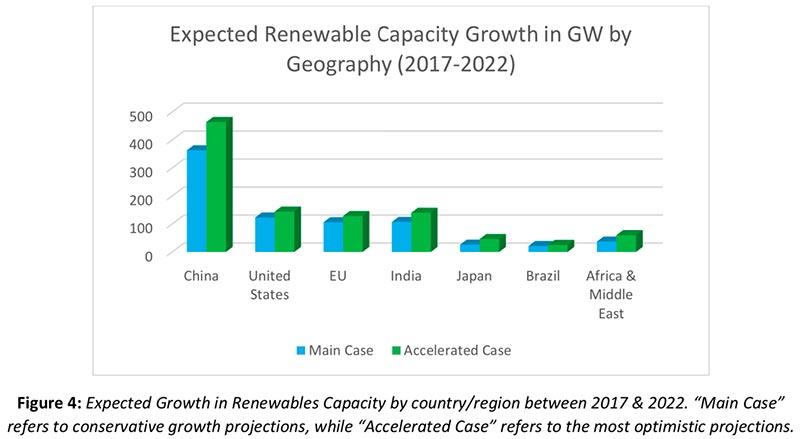

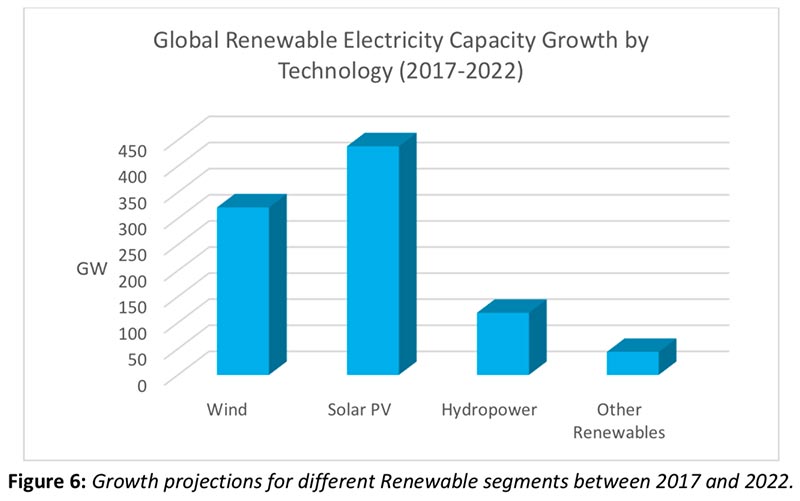

In a report published by the International Energy Agency, Global renewable electricity capacity is projected to grow by over 920 GW between 2017-2022, a growth of 43%. China will be the leading contributor geographically to the growth of renewable energy, accounting for 40% of the increase over this time span. To a large extent, China’s increased focus on Renewables as energy sources is a result of environmental concerns (pollution, greenhouse gas emissions, etc.), all of which were outlined in the country’s 5-year plan to 2020 which was adopted in March 2016 and which listed specific targets to be met linked to the reduction in dependence on fossil fuels. China has already exceeded its target for additions to Solar capacity and is expected to surpass its target for Wind power in 2019. In addition to these core sources of renewable energy, the country is also the world leader in terms of Hydropower and Bioenergy consumption for electricity, heat, and electric vehicles.

While the growth described in the above paragraph is significant, there is a real possibility that actual growth will surpass these projections due to technological improvements and government policies around the globe seeking to drive decarbonization. While conservative growth estimates suggest that over 920 GW of capacity will be added to the global renewables mix by 2022, more optimistic estimates show a potential for the growth to reach 1,150 GW by then.

In China, which is set to undergo the most growth in the renewable energy sector in the coming years, the rising cost of renewable subsidies, the long distance between renewable-resource-rich area from power- consuming regions and grid integration could be limiting factors to this growth. It will require a combination of strengthened and further power market reform, an investment in new ultra-high voltage (UHV) transmission lines, and an increase in decentralized power generation for the most optimistic renewables growth projections in China to come to fruition.

The United States’ Renewables expansion in the 2017 – 2022 timeframe will be surpassed only by China. Part of what will drive this growth in the US are policies at the federal and state levels that will continue to promote installation of onshore wind and solar capacity. A notable feature of these policies is established tax incentives that will promote the growth of decentralized Solar energy systems that will produce energy locally to where it will be used. Nevertheless, trade-related geopolitical tensions and federal policy that does not prioritize decarbonization will play a role in the extent to which Renewables grow in prominence in the US over the next few years.

India is another market looking to add significant renewable energy capacity, expecting to double its current output by 2022. Again, Solar and Wind will play leading roles, accounting for 90% of this growth, driven by the low prices yielded by capacity auctions for both technologies. The projection may turn out to be an under- estimate if grid infrastructure issues can be solved and if policymaking and innovation efforts geared at reducing costs are successful enough to provide a platform for further growth.

Growth in the EU from 2017 – 2022 is projected to drop to a lower rate than that of the previous five years due to a combination of factors. One of the reasons is that the strong growth over the previous five years has resulted in overcapacity and thus changed the supply/demand landscape. There is also a great deal of policy uncertainty and limited visibility on forthcoming auction capacity volumes.

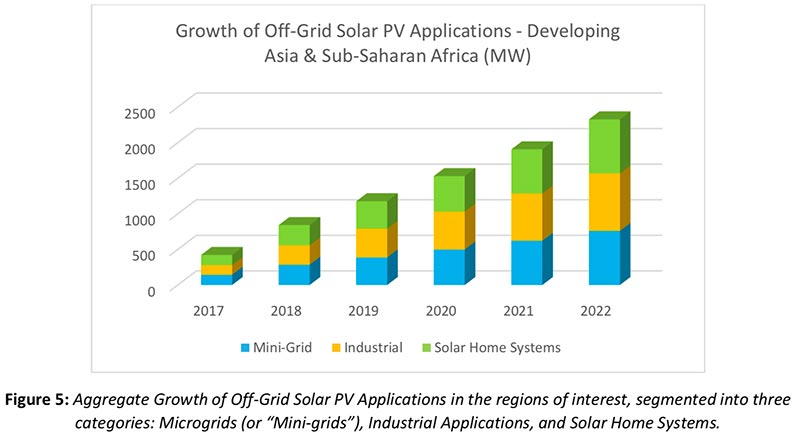

The coming 5-year period will mark the first time that the developing regions of Asia and Sub-Saharan Africa will have played a significant role in the growth of the renewable energy market, as depicted in Figure 5 below.

On the whole, about 70 million additional people in Asia and Africa will have access to basic electrification services over the course of this period, firmly as a result of the proliferation of decentralized Off-Grid energy systems, driven by a combination of government mandates and private sector investments.

Solar PV Leading the Growth Charge

In 2016, global growth in Solar PV installed capacity was greater than that of any other energy source, even surpassing the growth of coal (the traditional leader). In 2017 and 2018, the trend was much the same. Much of the growth observed in developing regions such as India was coupled to extremely competitive “reverse auctions” that helped buyers secure very low prices (as low as $30/MWh) from their generator suppliers, allowing Solar to inch forward as it strives for consistent cost competitiveness. China, which currently represents about half of global Solar PV demand, is expected to continue to play a key role in the expansion of Solar PV- the country is currently responsible for 60% of annual global solar cell manufacturing.

Of all Renewable segments, Solar PV is expected to lead the way in terms of capacity growth between 2017 and 2022, as highlighted by Figure 6. Growth projections have gradually become more optimistic over the past two years, having been bolstered by cost reductions associated with innovation in photovoltaic technologies and improvements in the efficiency of converting solar energy into electricity. Conservative estimates suggest that Solar PV capacity may reach 700-750 GW globally by 2022, with some optimistic forecasts predicting a global capacity of just under 900 GW by then (China accounting for 30-40% of the overall figure) in the event that certain favorable market drivers come to the fore.

However, barriers to growth continue to be influential. In China, for example, uncertainty has been fueled by renewable subsidies that continue to increase in size, placing a significant financial burden on the government. At the same time, there have been issues associated with integrating Solar energy into the centralized grid. Both issues have resulted in domestic policymakers and technology leaders taking steps to start addressing these problems, as mentioned next.

Firstly, they are moving away from the traditional Feed-In-Tariff (FIT) program to a new “green certificate” system. The FIT system is a price-driven incentive that allows transmission operators to feed in green electricity at defined prices (over long-term contracts) based on how that electricity is generated (hydro, solar, etc.). The goal of this tariff is to cover the additional cost associated with renewable energy sources compared to conventional ones. A “green certificate” program is a quota-based mechanism where regulators predetermine the quantity of electricity that should be generated via renewable sources. The regulators then submit the “green certificates”, with each one corresponding to a defined amount of energy to be produced via renewables, to generators who are then obliged to supply a certain percentage of electricity via renewable sources. Generators who do not comply with the quota will face penalty payments based on the quantity of energy not supplied via renewable sources. This new system will allow for stricter regulation on the quantity of renewable-based electricity that is supplied and for added cost-efficiency as there is no requirement regarding the form of renewable energy to be purchased- it can be chosen by generators based on geographic availability.

Regarding the issue of integrating Solar energy into the centralized grid, China is working to remedy this by updating their energy infrastructure with new transmission lines and expansion of distributed generation.

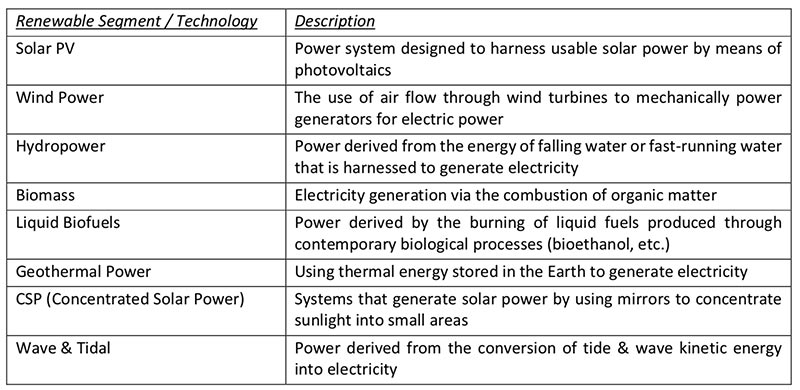

Renewable Energy Technologies

There are a number of renewable energy sources & technologies that have emerged in recent decades as presenting viable commercial potential. The key segments are summarized in the following table.

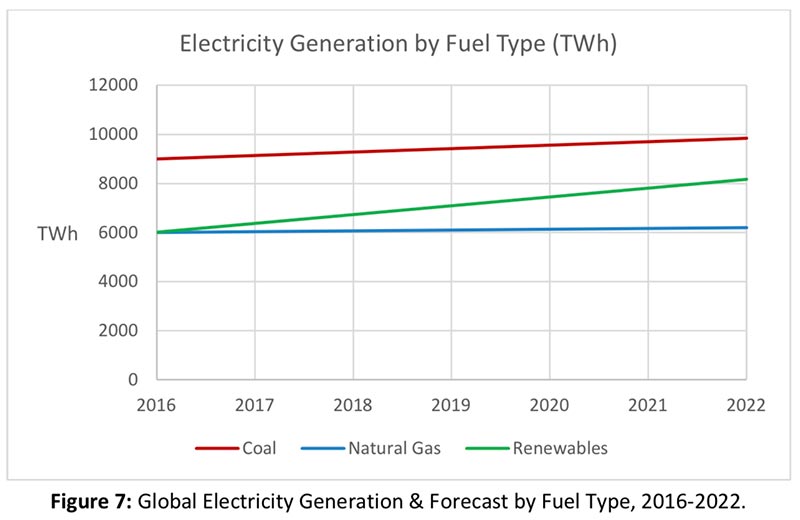

Figure 7 below depicts growth projections for power derived from Coal, Natural Gas and Renewables over the 2016 – 2022 period, as per a number of forecast models. All are expected to grow in the defined time frame, but Renewables will most likely capture significant market share from its counterparts.

TRENDS AND INNOVATION

Wind Power and Solar PV will account for over 80% of the Renewables capacity growth globally in the next five years. In some major European markets such as Ireland, Germany, UK, Portugal, Wind and Solar are likely to represent 25% to 35% of total energy generation by 2022, with cost impact. In developing markets such as China, India, and Brazil, the value will likely be closer to 10%. The projected global leader in renewable energy share of total mix will be Denmark, with about 70% of all their electricity expected to be produced via renewables. Significant investment in infrastructure and technology will be required for this growth to reach its full potential.

Factors that will Influence Renewables Growth

Development efforts are taking place in the following areas in order to continue bolstering the Renewables space and help it keep up with growing demand.

Battery Storage Capabilities

Lithium Ion Batteries have had a decrease in cost of 70% since 2012, driving massive growth in energy storage deployment. According to one study, residential solar and electric battery storage could become cost- competitive with grid electricity by 2020.

Pumped Storage Hydroelectricity Stations

These facilities, which pump water from a lower reservoir to an upper reservoir for storage until needed, allow for immediate electricity supply when there is high demand for power. By increasing plant capacity in terms of size and number of units, pumped hydroelectric storage generation can be concentrated and shaped to match periods of highest demand.

Wind Farm Digitalization

Digitalization is playing a large role and is allowing for much smoother integration of wind energy into existing energy grids. Wind Farm owners and operators are using advanced analytics, cloud technology, robotics, and artificial intelligence to improve value and reliability of electricity. Wind farms can increasingly enhance output by computing and performing analytics, they can be digitally integrated into more autonomous, self-learning systems in which turbines talk to each other, self-manage, and interact with the grid. The National Center for Atmospheric Research (NCAR) developed analytic software that applies AI to improve wind forecasting and helps utilities cut costs by enhancing system output and reducing requirements for backup generation.

RECENT US POLICY IMPLICATIONS

Much has been made of the current US Administration’s trade policies and lack of focus on decarbonization as a policy target, perceived by the public as a barrier to the long-term growth of renewable energy in the US. Examples of this are the 30% import tariff that was instituted on crystalline-silicon solar cells as well as tariffs on steel, aluminum, and inverters from China. However, there are rays of hope- the solar cell tariff will decline 5% annually until it reaches a minimum of 15%. Additionally, tariff exclusions on finished goods and geographic exemptions for Mexico and Canada should blunt the overall cost increase brought about by the tariffs. In the short-term, the US could actually see an increase in growth as developers are expected to accelerate new and ongoing projects to begin by the end of 2019 before the investment tax credit for solar falls from 30% to 26%, and prior to the production tax credit for wind phasing out in 2020.

Developments at the state and local level, as well as in the private sector where many businesses are ambitiously implementing sustainability goals, are also serving to boost the renewables sector. For example, Hawaii and California have both announced targets of 100% renewable energy consumption by 2045. The District of Columbia, Michigan, Vermont, Massachusetts, Connecticut, and New Jersey have all followed suit in setting ambitious targets for renewable energy usage.

Municipal initiatives are also promoting growth as mayors of over 200 towns & cities in the US have set targets to increase their renewable energy consumption to 100% of the total mix by 2035.

In addition, the US is poised to increase its footprint in the realm of offshore Wind Power in the coming years. Commercial successes in Europe for offshore Wind Power, along with falling capital costs due to technological improvements and supportive state policies, are driving offshore Wind growth in the US. In April 2018 the US Department of the Interior announced major lease sales off the coast of Massachusetts and began an assessment of Atlantic coast waters for potential future Wind Energy farms. Areas for Wind Farms in both New York and New Jersey are being considered, with possible development off the coast of California also being discussed for the first time.

RARE EARTH ELEMENT CONSIDERATIONS

Rare earth elements are some of the most in-demand metals in the world owing to their criticality in a number of military, electronic and energy systems. Metals such as neodymium, terbium, indium and dysprosium are especially relevant and play a vital role in the functioning of solar panels and wind turbines. Rare earths are produced via mining and refining activities, and China is dominant in this regard- over 80% of all mining activities and over 95% of all refining activities for the metals currently take place in China, partly because of the comparative lack of environmental regulations there compared to Europe and the United States.

The mining of rare earths is an extremely costly and wasteful activity from an energetic standpoint. Refining processes in particular require the consumption of large quantities of electrical energy per kg produced. Furthermore, key players in the mining sector have largely exhausted current mines and are having to spend more time, money and energy extracting reserves that are still attainable but that remain difficult to access in what is an extremely challenging process. As such, these mining companies have faced upward cost pressure for many years now, with energy costs increasing as mines are exhausted of their resources.

As many mines are isolated from the centralized grid, the required power is supplied via diesel generators. Since unit energy costs are increasing, mining companies have been looking for alternatives to expensive diesel power and in many cases, Solar and Wind have been able to fit the bill with their ability to store energy in remote areas away from the grid, often at a 70% lower cost compared to diesel. More and more, mining companies in the rare earth space in China and elsewhere are expected to turn to renewable energy solutions to satisfy their power needs in a cost-effective way. This is another driver that is expected to play an important role in the growth of the renewable sector in China in particular.

On the other hand, according to a scientific study funded by the Dutch Ministry of Infrastructure, in order to meet greenhouse gas emission reduction targets stipulated by the Paris Climate Accord, supply of rare earths such as neodymium, terbium, indium, dysprosium and praseodymium must increase by a factor of 12 by 2050. While untapped rare earth reserves are plentiful, the fixed costs associated with setting up new mines are prohibitive enough to present a significant obstacle for growth. New materials have been mooted as replacements for the metals in certain applications. Other options include recycling, but today’s recycling rate for rare earths is at less than 1%. Overall the mining extraction process for rare earths will have to be made much more efficient in order to drive further growth in the renewables sector on a commercial scale.

FUTURE OUTLOOK

While there is uncertainty regarding the rate at which the renewable energy industry will grow across the globe, significant long-term growth is expected due to the continued influence of a number of trends and factors, including:

- Governments and corporations around the world increasing their commitment to decarbonization through policymaking and innovation efforts

- The rapid growth of Renewables in emerging markets such as China & India

- Advancements in battery storage and digitalization technologies, which are respectively helping solve the problems of intermittency in power supply and integration of renewable power into centralizedgrids

- Increased focus on energy resilience which is being bolstered by advanced Renewable Energytechnologies – the proliferation of decentralized Renewable power generation stations will provide an integrated, active approach to energy management that should enable resilience with its diversity of supply and demand

- Rare earth element mining activities (primarily in China) which will increasingly transition from being diesel-powered to relying on solar and wind, especially in remote areas away from the grid where the majority of these mines reside

CONCLUSION- HOW DAYDREAM CAN ADD VALUE

As the geopolitical and cost issues associated with the extraction of rare earth elements multiply, companies s may start looking to alternative materials to be incorporated into electronic, and renewable energy systems. Daydream-Dynovel has the necessary expertise to assess the potential of new materials that may end up being crucial to the functionality and ultimately the growth of solar and wind technology, and is ready to work with chemical/metal/materials companies to better quantify the growth prospects of such materials and identify those that are best suited to add value in the long run.

Outside of rare earths, innovation is continuing to take place on the polymer/plastics/graphene/… front for new materials to be used on wind turbines especially, with significant development efforts also underway in the world of battery storage to find materials that can allow for more cost-effective operation. Daydream- Dynovel is uniquely positioned to assess the market for new polymers and metals to be used in energy systems having performed dozens of projects exploring such materials in a variety of applications across many industries.

If you are interested in working with Daydream on materials-related projects in the context of renewables, please contact contact@daydream.eu, contact@dynovel.com.

REFERENCE

- International Energy Outlook 2017 https://www.eia.gov/outlooks/ieo/pdf/0484(2017).pdf

- BP Statistical Review of World Energy June 2017 https://www.bp.com/content/dam/bp/en/corporate/pdf/energy-economics/statistical-review-2017/bp-statistical-review-of-world-energy-2017-full-report.pdf

- Monthly Energy Review – December 2017 https://www.eia.gov/totalenergy/data/monthly/pdf/mer.pdf

- Renewables 2017 https://www.iea.org/publications/renewables2017/

- New Tariffs to Curb US Solar Installations by 11% Through 2022 https://www.greentechmedia.com/articles/read/tariffs-to-curb-solar-installations-by-11-through-2022#gs.P64sIc8

- Renewable energy and electric vehicles dodge a bullet in tax bill https://www.cnbc.com/2017/12/22/renewable-energy-and-electric-vehicles-dodge-a-bullet-in-tax-bill.html

- FERC Rejects DOE’s Proposed Grid Resiliency Rule http://www.powermag.com/ferc-rejects-does-proposed-controversial-grid-resiliency-rule/?printmode=1

- 2018 Renewable Energy Industry Outlook https://www2.deloitte.com/us/en/pages/energy-and-resources/articles/renewable-energy-outlook.html

- Project Profile: Evaluating the Causes of Photovoltaics Cost Reduction: Why is PV different?https://www.energy.gov/eere/solar/project-profile-evaluating-causes-photovoltaics-cost-reduction-why-pv-different

- Analysis of Feed-in and Tradable Green Certificates (TGC) support mechanisms for renewable energy in Europe https://www.researchgate.net/profile/Hassan_Algarni/post/TGC-tradable_green_certificates_and_FIT- feed_in_tariff_model_for_RES_what_is_better_solution_why/attachment/59d6371779197b8077994784/AS%3A39156485 4611969%401470367744082/download/JIDC_17-3_45.pdf

- Pumped Hydroelectric Storage http://energystorage.org/energy-storage/technologies/pumped-hydroelectric-storage

- 2019 Renewable Energy Industry Outlook https://www2.deloitte.com/us/en/pages/energy-and-resources/articles/renewable-energy-outlook.html

- Grid Resilience is the Key to a More Renewable Future https://www.renewableenergyworld.com/articles/2018/09/grid-resilience-is-the-key-to-a-more-renewable-future.html

- METAL DEMAND FOR RENEWABLE ELECTRICITY GENERATION IN THE NETHERLANDS

- We Don’t Mine Enough Rare Earth Metals to Replace Fossil Fuels With Renewable Energy https://www.vice.com/en_us/article/a3mavb/we-dont-mine-enough-rare-earth-metals-to-replace-fossil-fuels-with-renewable-energy

- Database: Solar & wind systems in the mining industry https://www.th-energy.net/english/platform-renewable-energy-and-mining/database-solar-wind-power-plants/

- At Mining Sites Renewable Energy Systems are up to 70 Percent Less Expensive than Diesel Power http://www.mining.com/web/at-mining-sites-renewable-energy-systems-are-up-to-70-percent-less-expensive-than- diesel-power/