Introduction

Rare earth elements are all types of metal, consisting of 17 chemical elements: yttrium, scandium and the 15 lanthanide elements (lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, and lutetium). In contrast to the ‘rare’ in the name, rare earth elements are not so rare in the earth’s crust. They were given their name because the metals are very hard to exploit economically, due to their low concentration in the mine for economical extraction.

Consumers rely on rare earth for products used in every aspect of our daily life and industrial fields. Demand for rare earth has skyrocketed in the last decade with the development of the advanced technologies.

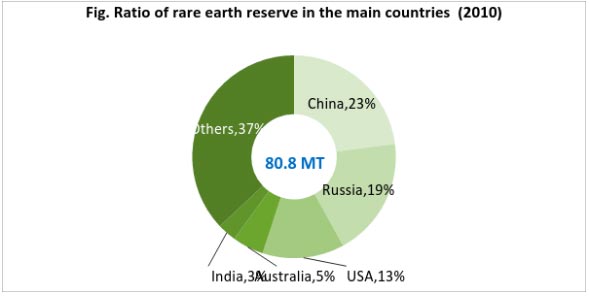

China is the dominant producer and user of rare earth in the world, occupying a 23% share of the total rare earth reserve and producing around 85% of rare earth products, especially the primary raw materials. Therefore, China has been a base of rare earth resources for the whole world.

In this article, Daydream will give a brief introduction of Chinese rare earth resources, if you need more information linked to rare earth and its down-stream industries, please contact contact(@)localhost, yusi.chen(@)localhost, jean-louis.cougoul(@)localhost.

RESOURCES

Traditionally, rare earth elements are divided into 2 groups: medium/heavy rare earth and light rare earth. Generally speaking, the light rare earth elements have a relatively low atomic number and small molecular mass compared with the medium/heavy ones.

According to the investigation and verification report made by Ministry of Land and Resource in China, China’s rare earth reserve occupies around 23% share in total rare earth reserve in the world.

*Rare earth reserve is calculated on a rare earth oxide equivalent basis

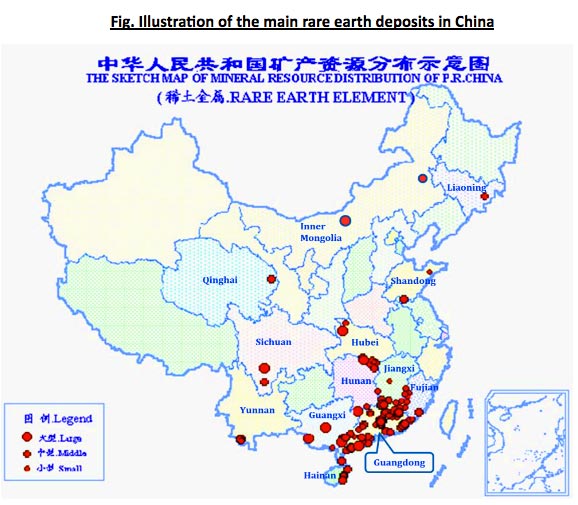

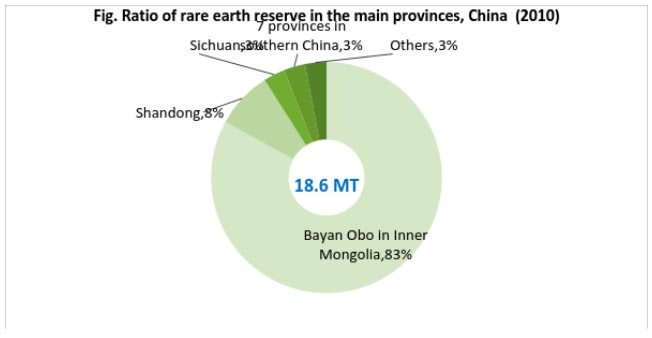

The distribution of rare earth resources in China is relatively concentrated. The light rare earth elements are mainly found in northern China, areas like Inner Mongolia and Sichuan Province, while the medium/heavy ones are mainly distributed throughout southern China in Jiangxi, Fujian, Guangdong, Guangxi and Hunan Provinces.

Medium/heavy rare earth in southern China is mainly of the ion-type. Since the total reserve of ion-type medium/heavy rare earth is much lower than that of the light rare earth in northern China, the value of this type of medium/heavy rare earth is higher.

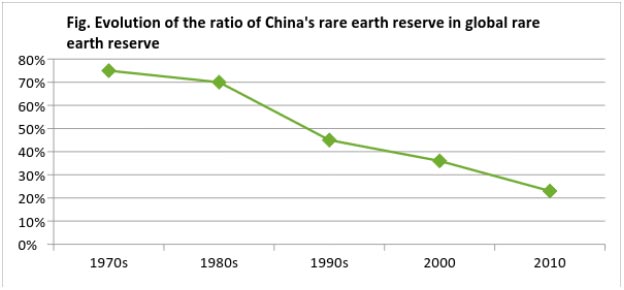

Despite of the large quantity of reserve identified in China, reserve of rare earth in China and its ratio in the world are decreasing every year due to the over-mining in the last decades, especially in the 1980s. Moreover, resources in some of the main mining areas have been exhausted in the past few years.

-

In Bayan Obo in Inner Mongolia, rare earth resources are now only 1/3 of what they were 30~40 years ago.

-

Reserve-Production ratio* of ion-type medium/heavy rare earth in southern China was 50 around 20 years ago but this ratio has now decreased to 15.

*Reserve-Production ratio is a method used to assess the size of reserves. The value represents the number of years that current reserves would last if their rate of use did not change.

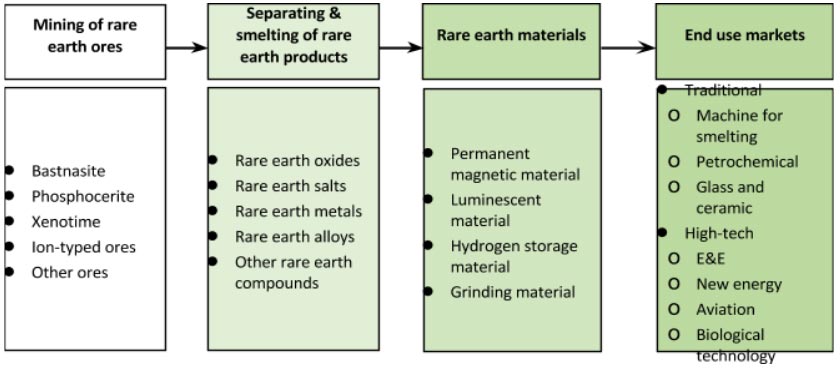

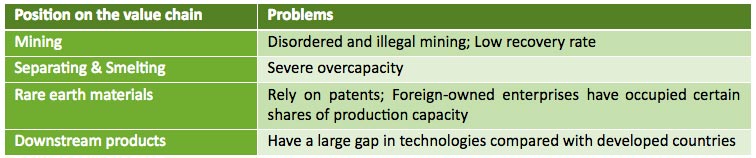

VALUE CHAIN OF RARE EARTH INDUSTRY

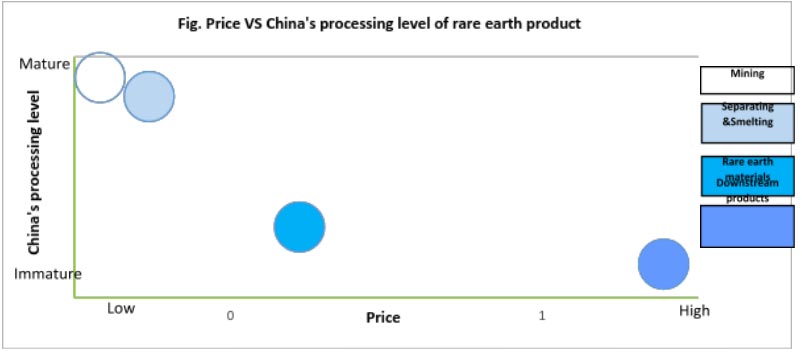

From the mines of ores to the end-users of permanent magnetic materials, Chinese companies play various roles on the value chain of the rare earth industry. However, even after decades of exploration and research, China still stands to be the largest provider of raw rare earth products, which is to say, a more up-stream positioning. Efforts are being made by both the enterprises and the governments to explore and develop a local rare earth industry towards the down-stream, where more value is created.

Rare earth materials applied in certain high-end downstream markets usually have high value compared with the value of the crude ores or the primary raw materials. Taking Neodymium magnet as the example, in its value chain of fine ores – rare earth carbonate – Neodymium oxide – Nd – Neodymium magnet, the price ratio of each product is 1:2:17:28:52.

Players at different position on the value chain are faced with their own problems.

PRODUCTION & EXPORTATION

China occupies a 23% share of the global rare earth reserve but produces around 85% of rare earth products in the world, especially in primary raw materials form. In the total production volume in China (including the illegal production volume), around 60% is applied for exportation. Of which, almost 75% are the primary raw materials. In other words, China has been a base of rare earth resources for the whole world.

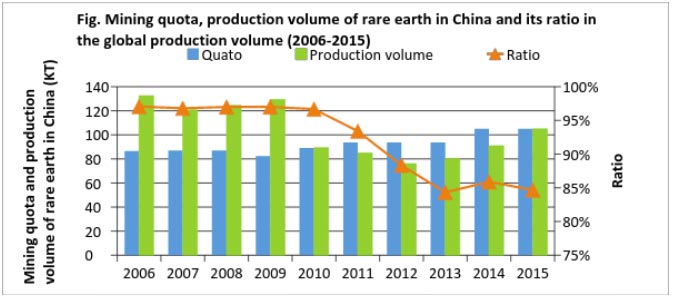

In order to preserve and rationally utilize the rare earth resources, since 2006, a quota was implemented in China for controlling the total mining volume of rare earth.

*Mining quota and production volume are both calculated on a rare earth oxide equivalent basis

*Production volume mentioned here is the weight of the rare earth ores

It is observed that this mining quota began to work after 2010 with strengthened management from China’s government. However, this quota has no binding for illegal mining and production.

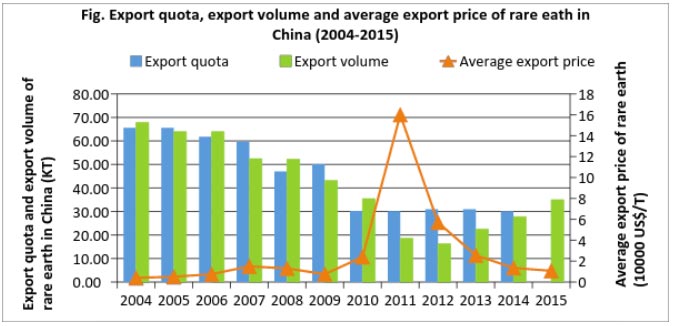

China also set a quota for rare earth exportation since 1999 but this quota was canceled in 2015, being replaced by the exportation permission.

*Rare earth products exported include rare earth crude ores, metals and compounds.

Price of exported rare earth increased sharply in 2011 because China, as the biggest producer, lowered exportation quota in 2010 and the buyers worried that the supply of the raw materials would be in short, so the price of rare earth increased. However, due to the downturn of downstream markets, demand for rare earth was lower than before. As a result, price of rare earth decreased since the second half of 2011.

Although China is the biggest exporter of rare earth in the world, it has low bargaining power compared with those few big rare earth companies in the developed countries. Because of the overcapacity, stiff competition and illegal mining, price of China’s rare earth will stay low in the long term.

MAIN ISSUES & SOLUTIONS

Overcapacity & depreciation of exhausted rare earth:

ISSUE : The slowdown in China’s macro-economic growth and the downturn of the downstream market lead to the recession of demand of rare earth. In 2015, the planned production volume was 95,000 tons and the unplanned production volume was over 25,000 tons. Additionally, the estimated domestic consumption of rare earth in China was 85,000 tons and the export volume was 27,000 tons. The gap is at least 8,000 tons due to the illegal mining and production. Even if China’s government canceled the export quota and changed the tax scheme in 2015, the whole rare earth industry would still be in the status of overcapacity. From Jan to Aug, 2015, the total export volume of rare earth from Shanghai port is 5,821 ton, 25.5% higher than that in 2014. And the average price dropped 13.9%, at around 133,000 CNY/ton (17,928 EUR/ton).

SOLUTION:

-

Starting with State-Owned mining companies, six Stated-Owned mining companies occupied over 90% of total domestic rare earth production. If they can lower capacity of rare earth production further, the balance of supply and demand can be achieved.

-

China government planned to purchase and store the rare earth as strategic resource and should take action as soon as possible to control the price and prevent the loss of rare earth resources.

-

China’s government should take strong stance on punishment for illegal rare earth mining and production.

Low value added products

ISSUE : Lacking advanced processing technologies, the rare earth processing in China is mining and separation. The main products of many rare earth mines are still roughly processed products, including ore with very low value. The rare earth materials and high-tech rare earth products rely on being imported from developed countries. The price ratio of fine ores, pure rare earth, rare earth materials and high-tech rare earth products is around 1:25:50:500. Therefore, the price for imported rare earth products is 2-20 times that of exported products.

SOLUTION:

-

Starting with State-Owned mining companies, six Stated-Owned mining companies occupied over 90% of total domestic rare earth production. Thus, the Chinese government should set more policies to encourage the State-Owned mining companies to develop new processing technology in rare earth material production.

-

Encouraging relevant tech companies to develop production technology on high-tech applications of rare earth to enhance the value of rare earth products in China.

REFERENCE

1. White Paper of the status and policies of China’s rare earth, 2012, the State Council

2. Yong XIAO, etc., Preliminary study on the asymmetrical development of the rare earth industry in China, 2013

3. Xiaoyu LI, etc., Tracking and analysis of the effect of mining quota on rare earth, 2015

4. Xinqiao PIN, etc., The Total Export Volume and Structural Changes of China’s Rare Earth Export: 1999~2014, 2016

5. Ministry of Land and Resource of People’s Republic of China, http://www.mlr.gov.cn/

6. Chinese Society of Rare Earths, http://www.cs-re.org.cn/

7. Mineral commodity Summaries and Mineral Year book for Rare Earths, U.S. Geological Survey. [Available at http://minerals.usgs.gov/minerals/pubs/commodity/rare_earths/]

8. Bradley S., etc., The Rare-Earth Elements—Vital to Modern Technologies and Lifestyles, 2014, U.S. Geological Survey [Also available at http://pubs.usgs.gov/fs/2014/3078/]