The Battery Show North America 2024 is the leading show of its kind in North America, and for the past 14 years has been bringing together professionals in advanced battery and electric hybrid & vehicles technology to discover ground-breaking products and create powerful solutions for the future.

Dynovel visited the Battery Show (Detroit, USA) from October 7th to 10th, 2024, and surveyed a sample of 70 companies, all offering materials, technologies, services and solutions to the battery and EV industries.

Table of content

1. Facts about the show

1a. Typology of 1,100 exhibitors

1b. Categories of 1,100 exhibitors

2. 2024 US Battery trends survey: 70 interviewees profile

3. Battery value chain profile

4. Battery Recycling positioning

5. Top areas of improvement for the EV battery industry

6. Obstacles to widespread battery recycling

7. Future of battery recycling methods

8. Last point: Common topics of interest

9. Conclusion

1. Facts about the show

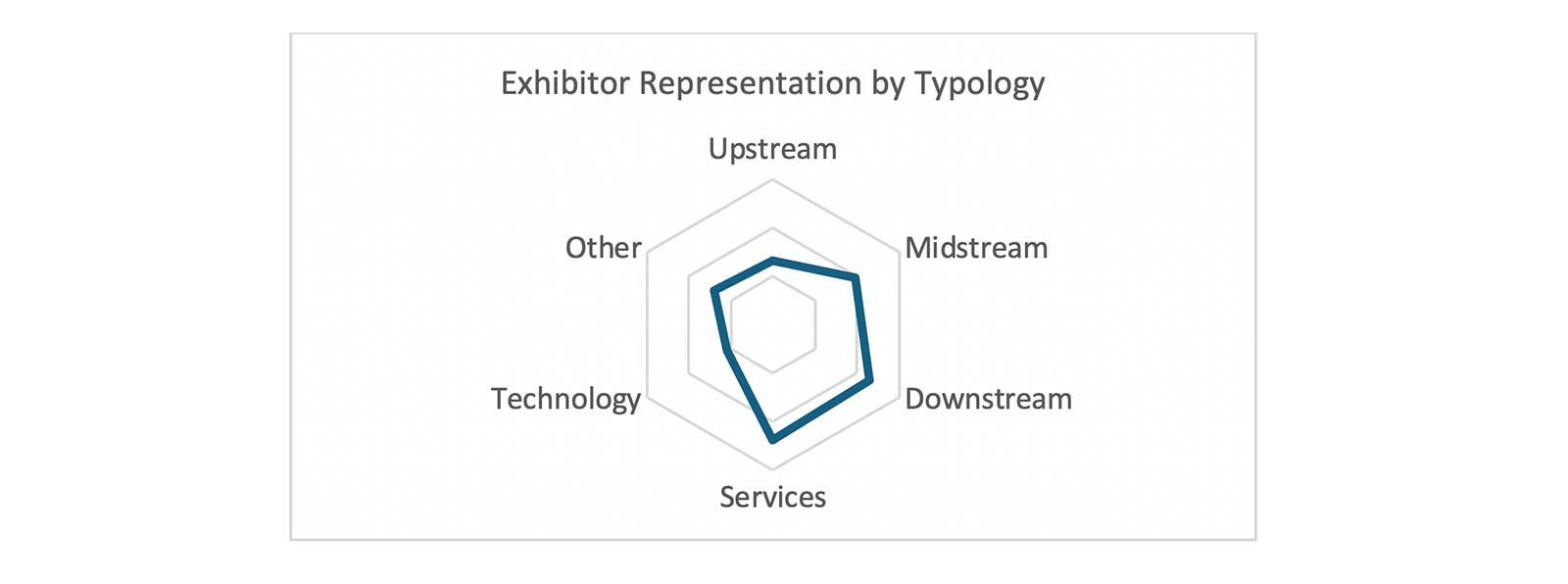

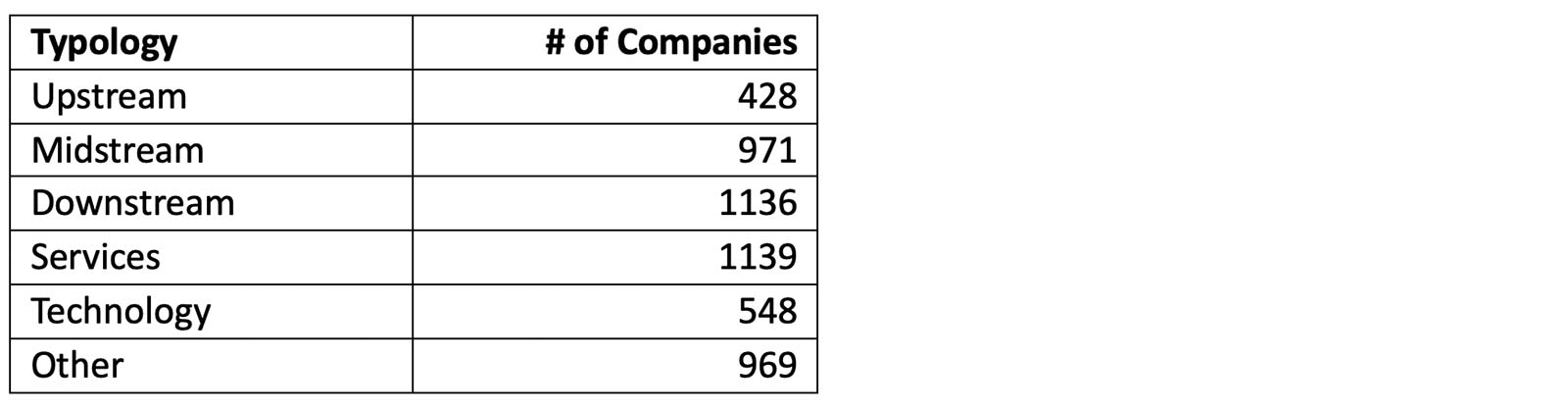

1a. Typology of 1,100 exhibitors

The Battery Show 2024 was filled to the brim with over 1,100 exhibitors and 17,000 attendees from around the world and all along the battery value chain.

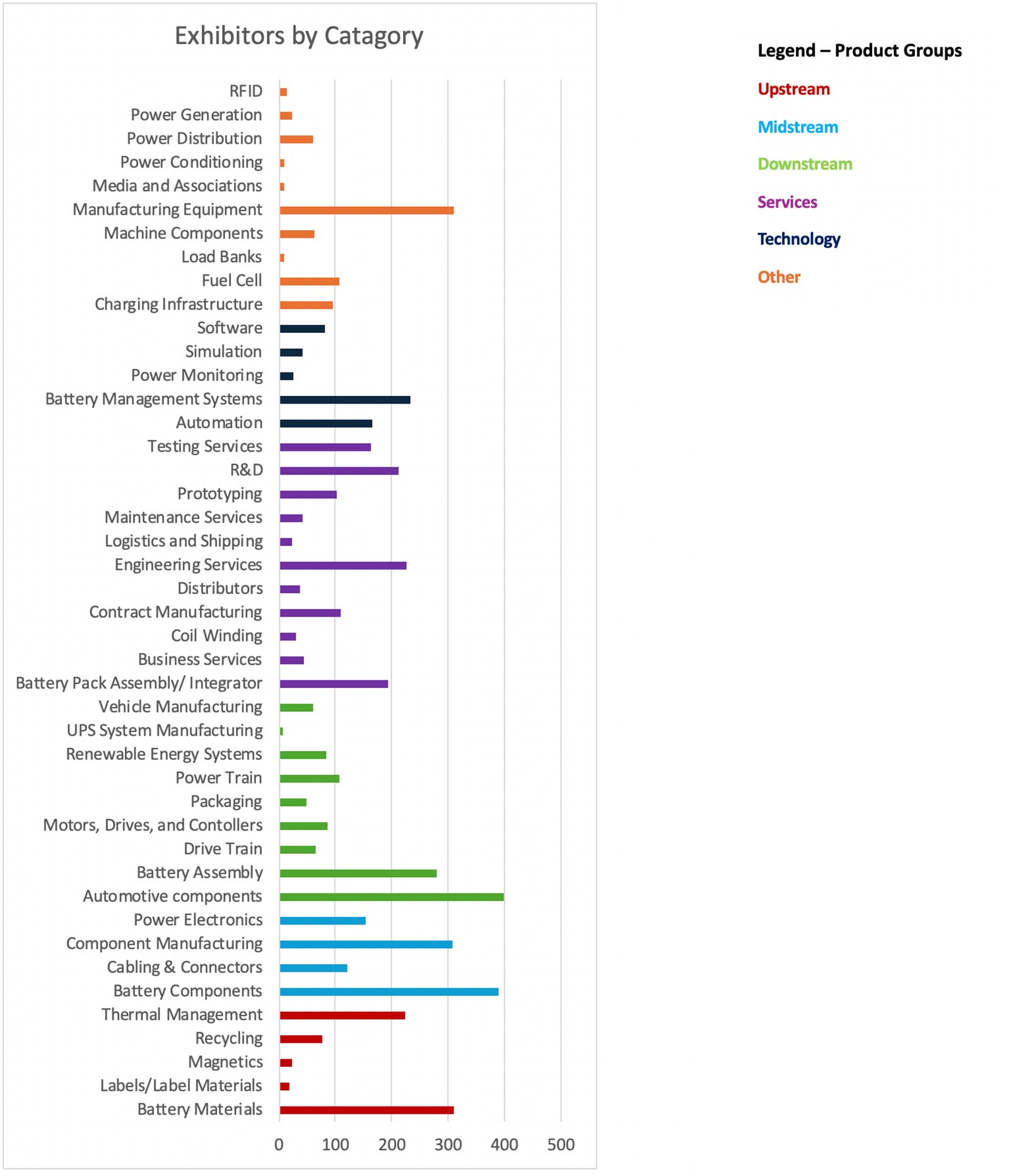

1,100 exhibitors at the Battery Show could identify themselves as falling under 44 different categories (see chart below).

We grouped these categories into 5 typologies plus “Others”. The 5 typologies were Upstream (chemicals and materials), Midstream (parts and components), Downstream (modules, battery systems, etc.), Services (including manufacturing, business, and logistics services), and Technology (software and instrumentation).

1b. Categories of 1,100 exhibitors

*Note: exhibitors may select multiple categories that they belong to

2. 2024 US Battery trends survey: 70 interviewees profile

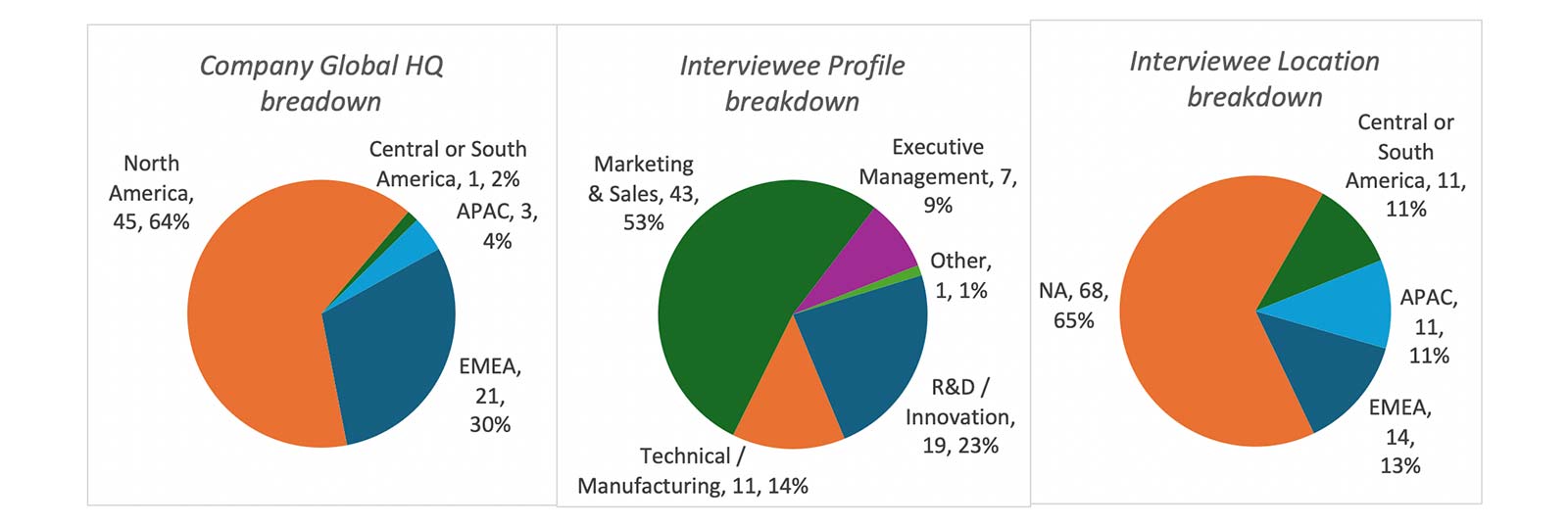

Dynovel had a unique opportunity to interview 70 exhibitors and attendees at the fair covering different regions and involved in various roles within their companies.

In summary:

- 64% of the interviewees are working for American companies

- 30% for European companies

- 4% for companies in APAC.

Almost all interviewees serve North America in their roles, with all other regions being served by 20% or less of interviewees (20% had responsibilities in EMEA, with APAC and Central or South America having 15% each).

A majority of respondents occupy a function in Sales & Marketing followed by R&D / Innovation. The remaining 24% are in Executive Management, Technical and Manufacturing, or “Other” roles.

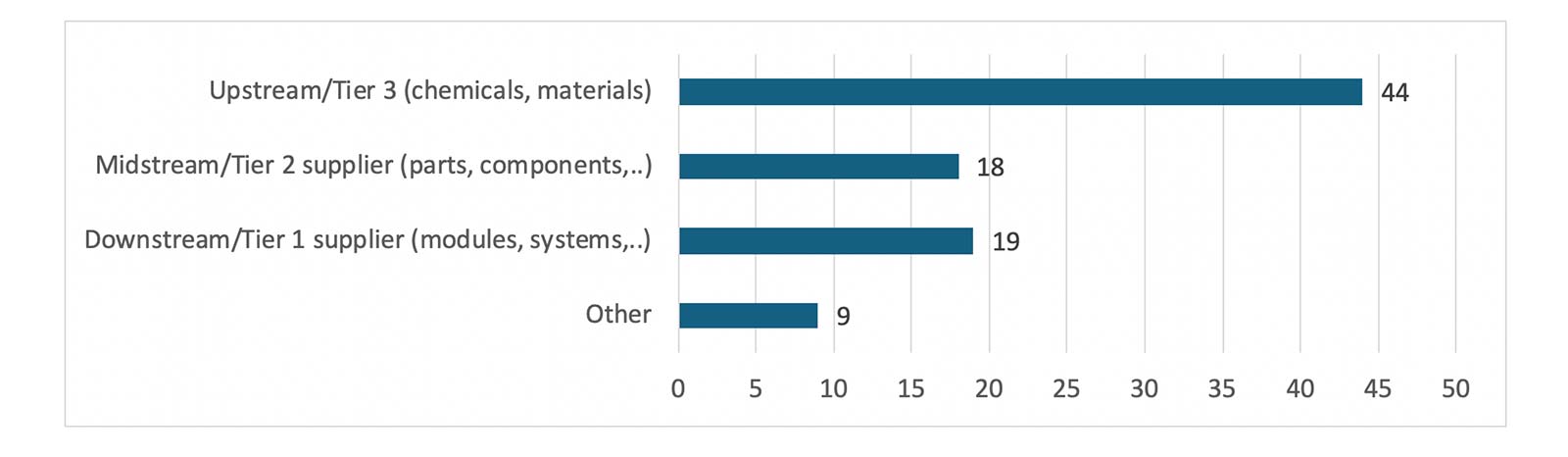

3. Battery value chain profile

The interviewees’ companies reflect all components of the value chain: downstream (modules, systems, etc.), intermediate (parts, components, etc.) or upstream (chemicals and materials, including battery recyclers); and “Other” category (technology suppliers, equipment producers, research institutes…).

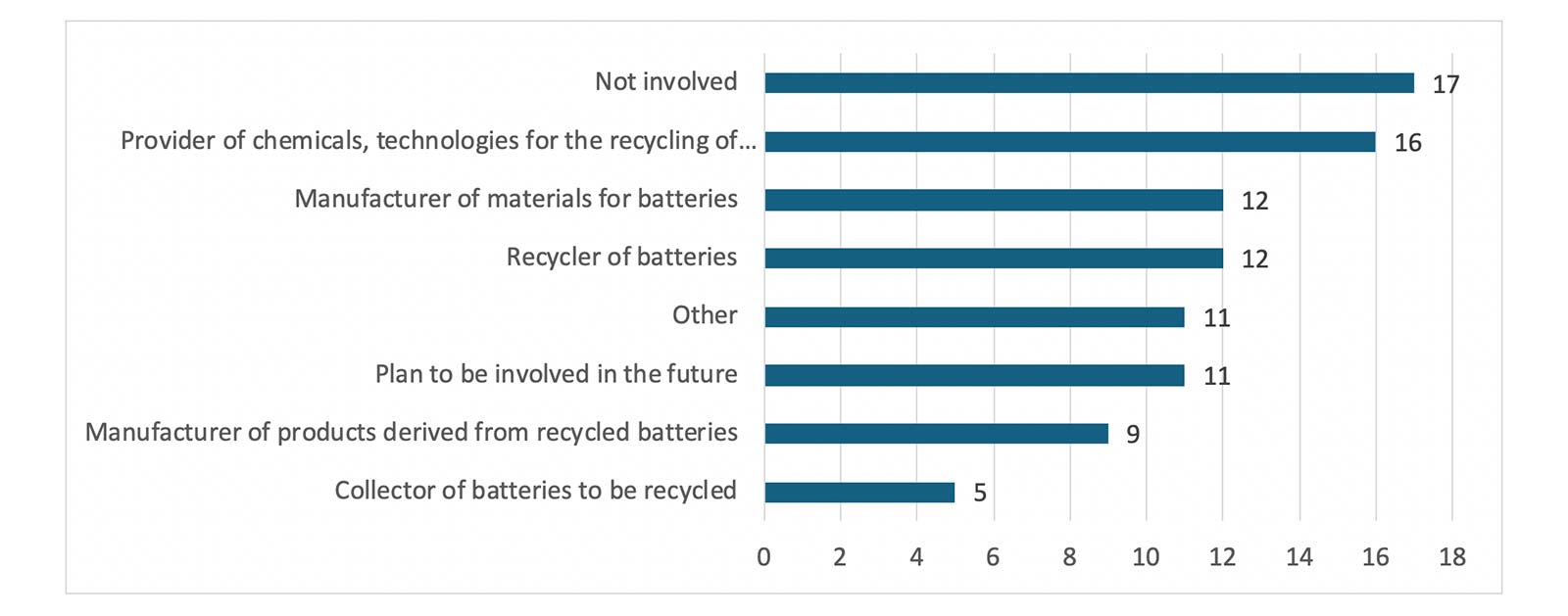

4. Battery Recycling positioning

Interviewees were also asked how they are involved with battery recycling or how they might become involved in the future. The battery recycling industry is still in its very early stages, as evidenced by 40% of interviewees responding they are not involved or that they only plan to be involved in the future. Companies currently involved as battery recyclers made up 17% of responses.

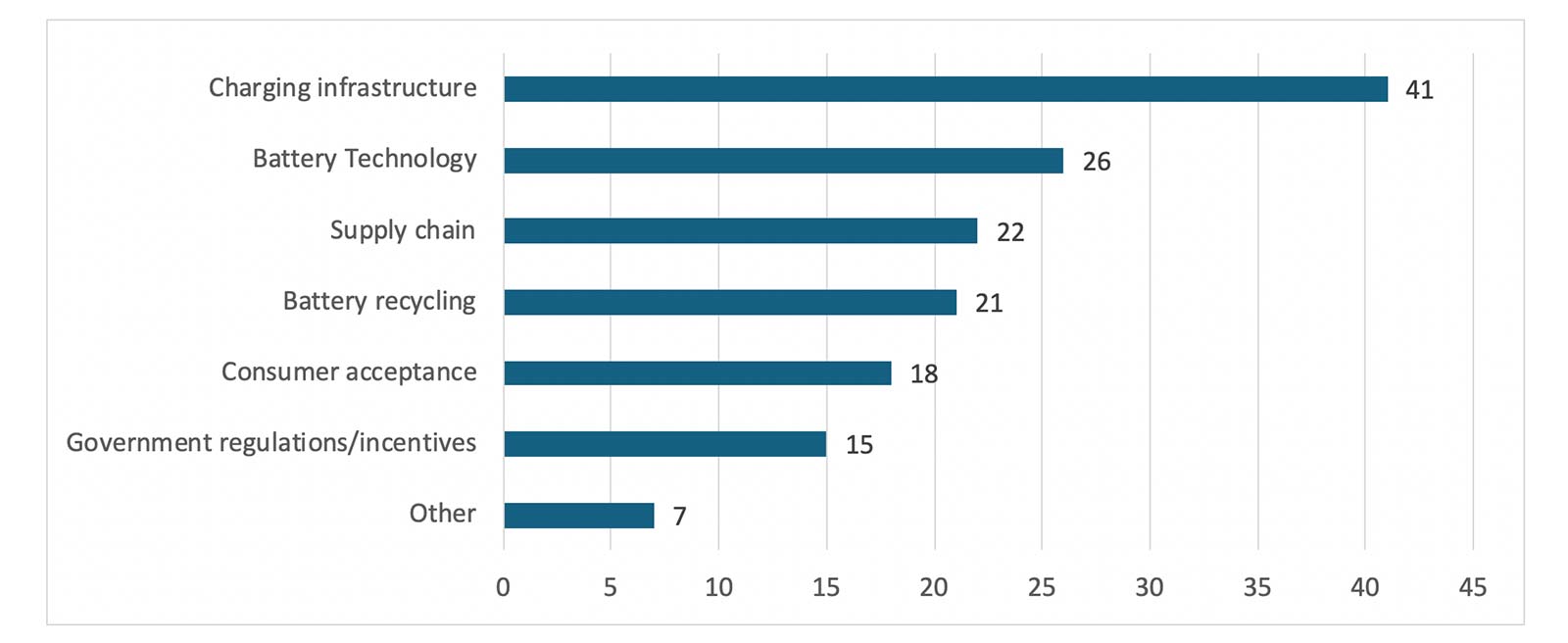

5. Top areas of improvement for the EV battery industry

Question: To drive the EV industry forward, improvements should be made where? Up to two options could be chosen.

Charging Infrastructure and Battery Technology received the most mentions, with interviewees mostly agreeing that consumer acceptance would follow development in these two areas. Improvements to charging infrastructure is viewed by many respondents as driver of consumer acceptance, as it will quell concerns related to range anxiety and make EVs more practical to own. Likewise, improving battery technology will drive consumer acceptance as well by making EVs less expense and better performing.

The third most important area of improvement mentioned was the Supply Chain, which includes concerns around sourcing raw materials and all the way through to cell pack assembly. Close behind improving supply chain, was the need to improve battery recycling.

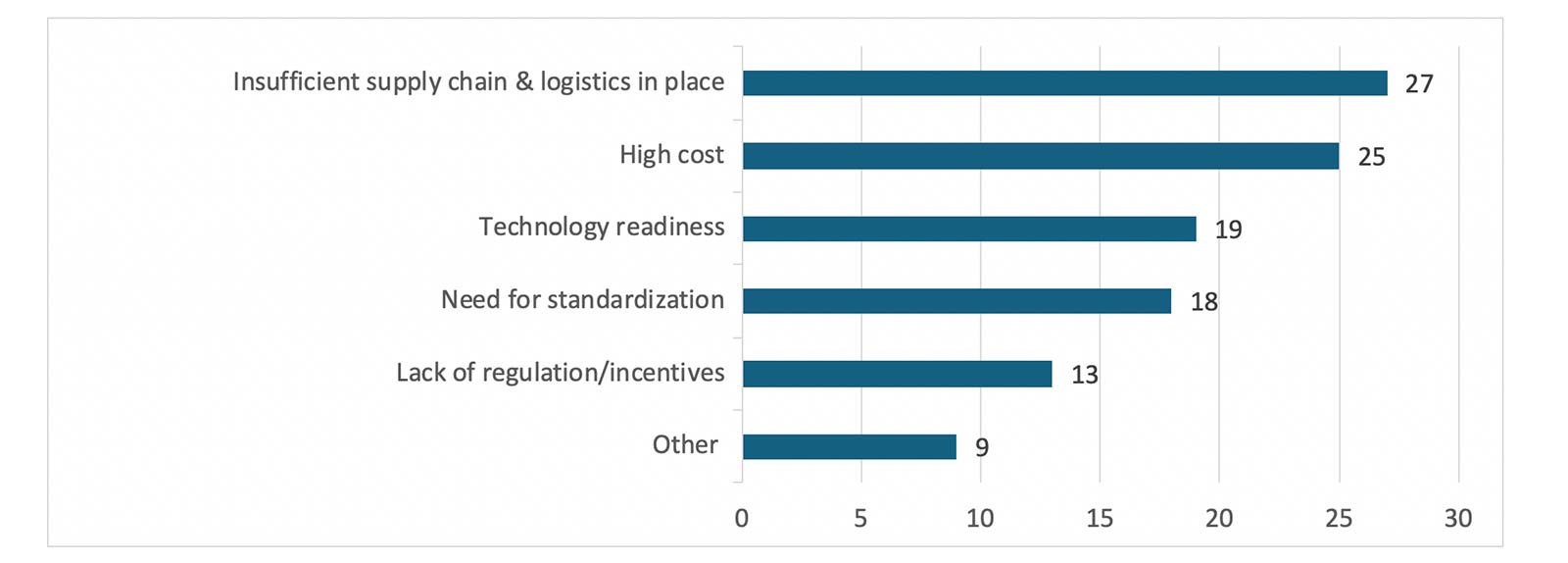

6. Obstacles to widespread battery recycling

Question: What poses the biggest challenge to the success of widespread battery recycling? Insufficient Supply Chain and Logistics in Place, followed by High Cost were the top two responses.

The “reverse logistics” of battery recycling is seen as a hurdle, due to the challenge of collecting used batteries across the continent, sending the batteries through each step of the recycling process, to eventually the point where the recycled materials can be integrated back into the battery supply chain. Where batteries are currently being produced is another hurdle in the supply chain. If there is not substantial battery production in North America, there will be much less demand for battery recyclers in North America.

“Success of battery recycling will come down to if companies can figure out these ‘reverse logistics’” – Supply chain manager @ Battery materials supplier.

“The supply chain is too disjointed. Collectors, disassemblers/black mass producers/ recyclers, and end users (battery manufacturers) need to work better together to smooth out kinks in the supply chain”. – Director @ Battery manufacturing partner

Readiness of technology and the need for standardization also received considerable mention. Readiness of technology was often tied to high cost and concerns over quality of the recycled materials produced. The effects of changing battery chemistry on battery recycling technology have been mentioned several times.

7. Future of battery recycling methods

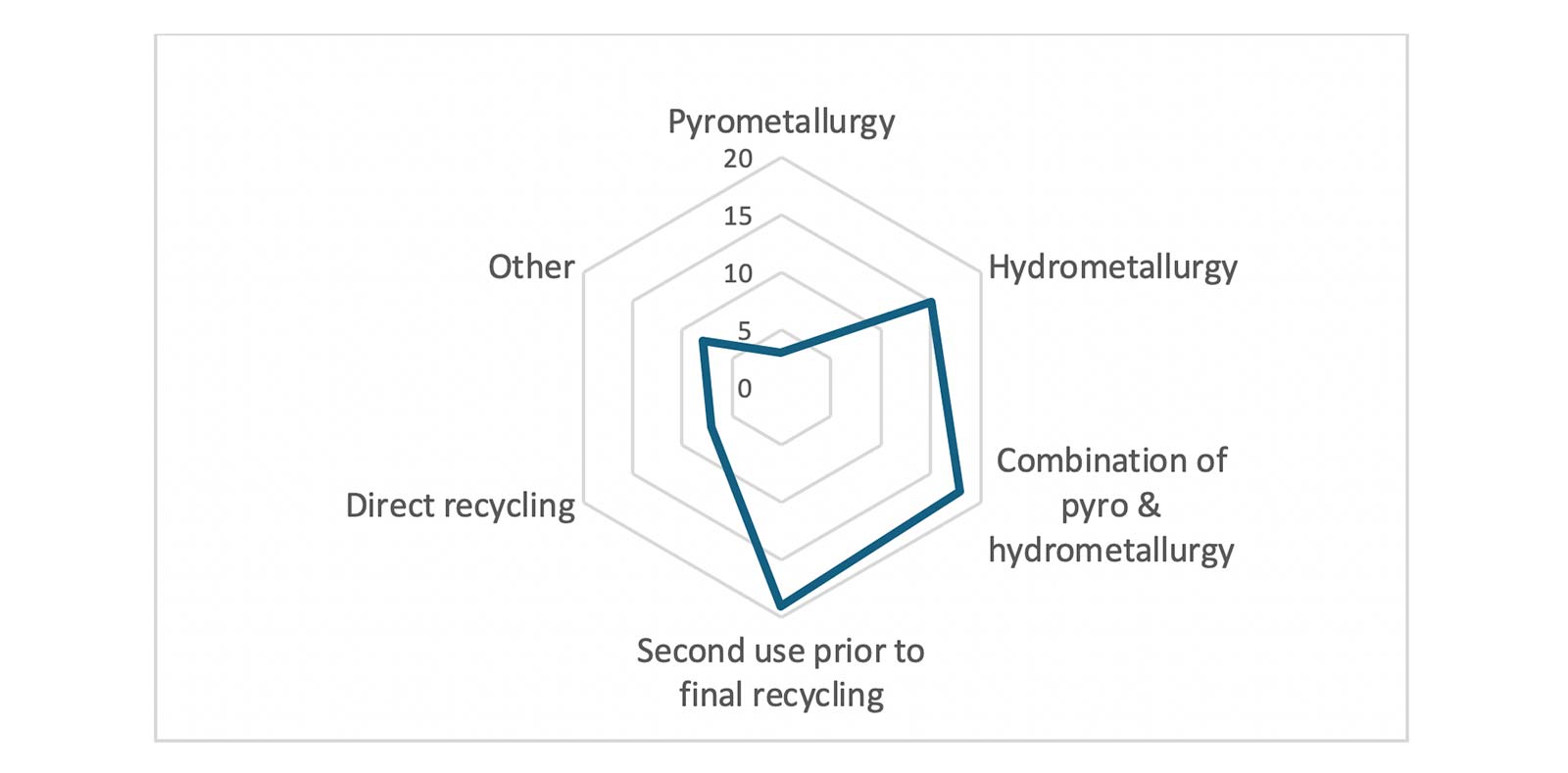

Question: What battery recycling technology will be most utilized in the future?

Second Use prior to final recycling was viewed as the most immediate step forward in battery recycling, with long term outlooks favoring Hydrometallurgy or a combination of Hydro- and Pyrometallurgy.

A common thought amongst interviewees is that Second Use will be the first option for end-of-life EV batteries. Those batteries no longer suitable for EV use will still typically have around 80% capacity, which is still serviceable in less intensive applications such as secondary storage. It was pointed out by several interviewees that Tesla is already doing this by incorporating their end-of-life EV batteries in their Tesla Powerwall stationary storage units.

When batteries finally come to the end of their useful life, most optimism is seen in Hydrometallurgy as the best method of recycling. Reasons given for this include that Hydrometallurgy allows for the recovery of lithium, has potentially better environmental profile than Pyrometallurgy, and the method is already being adopted most by leading North American battery recyclers and emerging players alike. Hydrometallurgy is said to be the best option for circularity in the battery industry.

“The best future recycling technology depends on what company wants to get out of the process… If they want to put the material back into batteries, then Hydrometallurgy is best” – Manager @ Material supplier to battery manufacturers and recyclers.

8. Last point: Common topics of interest

Economics of battery recycling and the supply chain received extra attention from interviewees:

- How will recycled battery materials eventually compare to virgin materials, in cost and quality?

- When will battery manufacturing and batteries reaching end-of-life in North America get to the level where recycling can be commercially viable?

- How technological changes will improve or hurt the economics of battery recycling? Examples:

- Recycling processes successfully scaling up

- Less valuable chemistries in future batteries (for instance the growth of LFP batteries)

- How to better understand the logistics and supply chain requirements?

- What is the most optimal system for collection of end-of-life batteries?

- Where is black mass being sent and what needs to be in place to keep it in North America?

- What would be required to decentralize the recycling process?

9. Conclusion

Participating in the Battery Show is a unique opportunity to meet key players in this industry in the USA, and it allows us to observe that:

- The battery industry is growing and becoming more structured in the US

- The Asian industry is underrepresented

- Current challenges are not only technological but also involve infrastructure and the supply chain

- Recycling is clearly emerging.

About Daydream – Dynovel

Daydream – Dynovel, active in Battery and Automotive industries for 25+ years, severs clients globally and regionally (North America, Europe, China, Japan, Korea, India) in the Chemicals, Polymers, Advanced Materials, Energy, on helping our clients address their pain points, their growth objectives and your strategy.

To move forward quickly and surely in this Industry, the easiest way is to contact us : stephanie.lorini@dynovel.com; yusi.chen@daydream.eu; jean-louis.cougoul@daydream.eu