Introduction

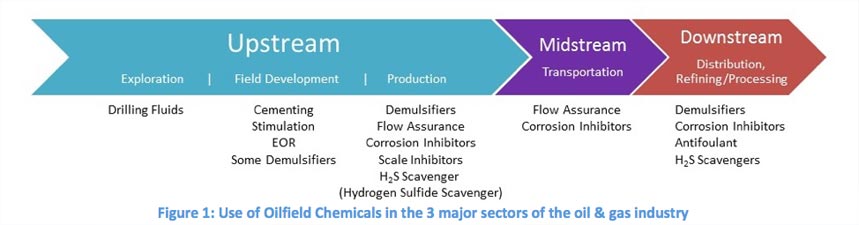

The oil & gas industry can be divided into three distinct segments: Upstream, Midstream & Downstream. The upstream segment focuses on Exploration and Production (E&P). The midstream segment is concerned with the transportation and storage of crude or refined petroleum products. The downstream segment deals with the refining, distribution and retail of petroleum crude oil, processing and purifying of raw natural gas and provide raw material for Chemistry.

Many chemicals called Oilfield Chemicals (OFC) are used throughout the process. These chemicals are usually supplied by Specialty Chemical Companies such as BASF, Clariant or Solvay to name a few. OFC’s main families of products are Drilling Fluids and Production Chemicals.

In this article, we will examine some of the recent trends in O&G in North America, such as the recent surge in mergers and acquisitions in Production Chemicals, and describe the impact of these changes in the industry. We have illustrated how these mergers and acquisitions affect the acquirers’ positions on the value chain.

Oilfield Chemicals

A wide range of chemicals are used within the oilfield sector, mainly in Exploration & Production (Upstream) with Drilling Fluids and Production Chemicals and in midstream with chemicals such as anticorrosion agents for pipe integrity. BASF SE (Germany), AkzoNobel N.V. (Netherlands), The Dow Chemical Company (U.S.), Lubrizol Corporation (U.S.), Kemira (Finland), Clariant (Switzerland), Huntsman (U.S.) are some of the companies providing OFCs.

Production chemicals, who make the broader family of Oilfield Chemicals, take part in the process of separation and purification of crude oil and gas (upstream) and are also used in the midstream segment where corrosion inhibitors are an essential aid to safeguard the installation integrity. Some of the production chemicals are:

- Demulsifiers/emulsion breakers, one of the more significant production chemicals, used to separate water from oil, a part of the processing that is required for crude oil production.

- Corrosion inhibitors (required all along the process stream to safeguard installation integrity),

- Paraffin control agents or flow assurance (to prevent the deposition of paraffinic fluids that can occur under pressure or temperature change or turbulence) such as paraffin dispersant, paraffin inhibitors, pour point depressants

- Scale inhibitors (to prevent inorganic salts deposition)

- Asphaltene inhibitors (to prevent the deposition of these polycyclic aromatic molecules)

- Biocides (to prevent biological contamination once a hydrocarbon reservoir is connected to the surface)

- Water clarifiers (to ensure that the water separated from the crude oil is sufficiently free of hydrocarbon before water disposal).

- Foamers

Drilling fluids are another crucial family of chemicals used primarily during the Exploration phase. Some functions of drilling fluids include applying hydrostatic pressure, which prevents formation fluids from entering wells and maintaining the temperature and cleanness of the drill bit in order to increase the rate of penetration.

Other families of Oilfield chemicals are also used in the following processes:

- Cementing, a process by which wellbores are protected and sealed. The process is frequently used to permanently shut off water penetration into a well.

- Stimulation, a process by which well production is increased by the improved flow of hydrocarbons from drainage areas to wellbores.

- EOR (Enhanced Oil Recovery), a process by which several techniques (among them surfactants and polymers) are employed to increase the amount of crude oil which can be extracted from an oilfield.

The figure below illustrates the main segments where OFCs can be applied:

O&G Mergers & Acquisitions in recent history in North America

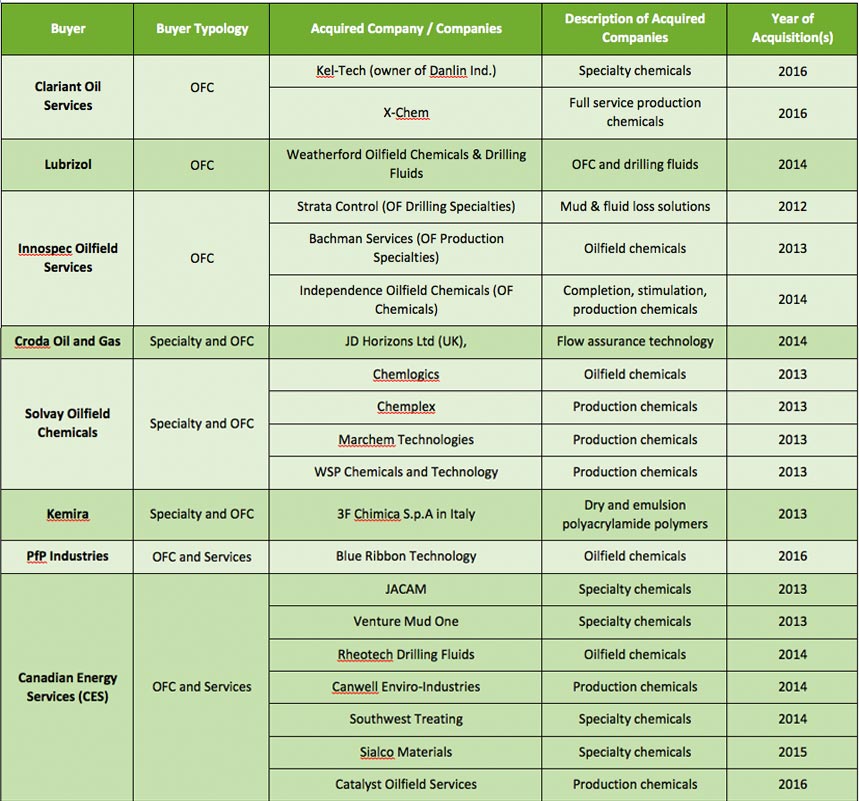

In recent years, there has been a definite pattern of mergers and acquisitions within the oil & gas industry in North America especially in the field of Oilfield Chemicals. For example, some of the major acquisitions are listed in the following table:

- With their dual acquisition of Kel-Tech, a specialty chemical company, and X-Chem, a full-service production chemical company, in September 2016, Clariant not only increased its total sales by $200 million, but also gained an opportunity to expand its product line, production capacities, and client portfolio. These acquisitions allowed Clariant to increase their market share in the service part of production chemicals where they interact directly with the Oil & Gas companies.

- Innospec´s focus on North America Oilfield is recent and motivated by expansion into an adjacent market. They performed 3 acquisitions in 3 years (Strata Control Services – Drilling specialties, Bachman Services – Production specialties, and Independence Oilfield Chemicals in 2012, 2013, and 2014 respectively) in order to create a “new mid-tier leader” in Drilling, Completion & Stimulation and Production chemicals and services.

- Solvay’s previous line of production chemicals was limited to rheology modifiers, biocides, and anti-gas migration. With the inclusion of Chemlogics, Solvay can now offer demulsifiers, H₂S scavengers, and flow-improver among other diversified production chemicals. According to Solvay, “this acquisition accelerates [the company’s] in-depth transformation towards a higher growth, less capital intensive and greater returns Group.”

- Canadian Energy Services (CES), a company active on the external growth front since its inception in 2001 has speed up the acquisitions since 2010. Most notably, CES acquired JACAM Chemical Company, a distributor and manufacturer of oilfield specialty chemicals in the US in March 2013 for $240 million. These acquisitions aim at giving CES a competitive advantage by combining an oilfield knowledge and service company culture with vertically integrated manufacturing capabilities.

Another notable event has been in 2011 the four-way combination between 4 separate companies – Benchmark Performance Group, Inc., EnerMAX Services Limited Partnership, Red Oak Water Transfer, Inc. and Reef Services Holdings, Inc. – to form Rockwater Energy Solutions, Inc., a water management, chemical and logistics services company. In March 2017, Rockwater, in a $207 million deal, bought Crescent Companies to form a leading water management company.

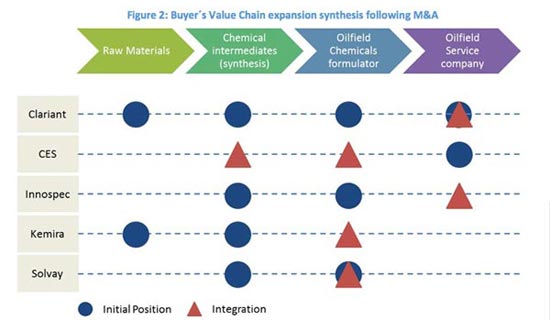

We found that the companies generally performed these acquisitions in order to strengthen their product portfolios, increase their presence in certain markets and expanded their reach along the value chain. The acquired companies were primarily focused on the formulation and manufacturing of Production Chemicals.

Acquisitions can also be motivated by the desire to penetrate a new market. One of the newest players in the North American oil & gas upstream market is Dorf Ketal, an India based global leader in specialty chemicals. Dorf Ketal, which was already present on the offshore oilfield in Brazil, established their position in North America with the acquisition of FlowChem, a specialty oilfield chemicals provider based in Rayne, LA.

Buyer’s profile

2 profiles of buyers can be identified: Specialty Chemicals companies and Oilfield Services companies.

Specialty Chemicals companies with a broad product portfolio and/or a leading position in selected raw materials/intermediates have decided during the boom period in North America to invest downstream via the purchase of Specialized Oilfield Chemicals Companies or Oilfield Chemicals & Service companies. These investments were done either to:

- capture a larger portion of the product value (currently held by the large service companies),

- secure market position and sales volumes of specialty chemicals for oilfield in a highly competitive environment (e.g. Clariant & Solvay),

- get a better understanding of the final product requirements and thus improve their own R&D (e.g. Croda)

- access new markets (e.g. Lubrizol & Innospec), sometimes adjacent for some of their standard product portfolio (Innospec with PPD)

Opposite to exploration / drilling / fracturing segments, where a combination of technologies, equipment and chemicals enable to sell a “solution” (e.g. realize fracturing & completion for a fixed price), the production segment enables solely for the water treatment part to charge for a total service/solution. Production chemicals, especially demulsifiers and paraffin inhibitors need extensive testing and tailored formulation, a business closer to oilfield chemicals companies than service companies.

Within the Oilfield Service companies – related to production chemicals – there had been very few major acquisitions/mergers over the last 5 years:

- One notable event is the $2.3 billion purchase in 2013 of Champion Technologies by Ecolab Inc, Nalco’s mother company to form Nalco Champion, an oilfield service company of revenue exceeding $3 billion.

- Canadian Energy Services stepwise has built a diversified portfolio of Oilfield Chemicals, Drilling Fluids, Services & Equipment supply to reach a 34% market share in Canada and 10% market share in the USA (according to recent CES investors presentations).

To add to the concentration effect that all these M&A have in this sector, some players also ceased activities in recent history:

- Tiorco, a 50/50 joint venture between Stepan and Nalco created in 2008 following a renewed interest in enhanced oil recovery (EOR) technologies pushed by increased price of crude oil, was dissolved in 2015 due to significant drop in surfactant demand for EOR projects, a consequence of the low oil prices.

- Messina Chemicals, Inc., an oilfield chemicals and services company founded in 1968, ceased activities in late 2016 due to market conditions.

- Lubrizol’s Oilfield Solutions unit, the result of the acquisition of Weatherford’s oilfield chemicals and drilling fluids businesses for an estimated $750 million in 2014 was sanctioned 2 years later with pretax losses of $365 million and the company is now looking to shut down or sell many of its Oilfield Solutions locations.

The figure below illustrates the different types of buyers and their strategic objectives:

Conclusion

In this article, we have looked the recent trends in the oilfield chemicals market, especially the mergers and acquisitions that occurred over the last 5 years. This trend of M&A can be attributed to the increased attractiveness that the oilfield segment (especially the unconventional part) represents for large surfactants and polymers producers, a growing desire for integration across the value chain to capture value, and the need for companies to develop a closer relationship with end users. By completing M/A, companies can also sharply increase their manufacturing capabilities for production chemicals, or general oilfield chemicals.

This acquisition spree has not showed any sign of slowdown with acquisition as recent as December 2016, but the acquisition race has, especially in production chemicals formulators’ field, left very few mid-size players on the market. In that regard, it will be interesting to see how the (Oilfield) Specialty Chemicals companies who stayed on the sidelines until now will react and contribute to the trend as current forecasts look positive for the industry with a “slow” but steady growth of demand and production of crude oil despite recent crises faced in 2008 and 2014.

To contact us:

contact@www.daydream.eu, jean-louis.cougoul@www.daydream.eu, jean-pierre.molitor@www.daydream.eu, yusi.chen@www.daydream.eu, stephanie.lorini@dynovel.com