DAYDREAM attended the Vitafoods Trade Show in Switzerland on May 14th and 15th, 2024 and took the opportunity to conduct a survey involving 33 companies and professionals all offering nutraceutical solutions (dietary supplements, vitamins, and functional foods…) to the industry.

1) Companies & Professionals Interviews sample

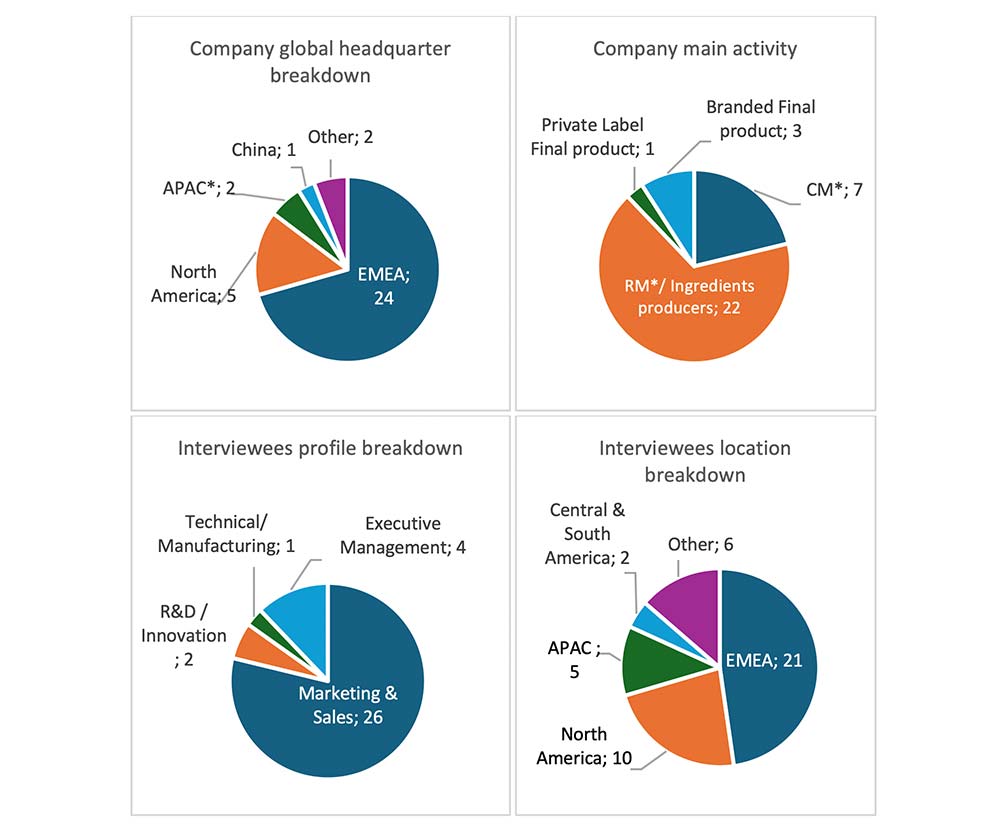

Most interviewees, approximately 70%, are working for European companies. North American companies account for 15% of the respondents, while 6% work for companies in the APAC region (excluding China or India). Only 3% of interviewees are associated with Chinese companies.

The primary activities of the interviewed companies involve raw material (RM) /ingredients production (67%), followed by contract manufacturing (21%), production of branded final products (9%), and private labeling (3%).

The majority of interviewees (48%) are based in the EMEA region. Among them, the most prevalent role is in Marketing & Sales fewer (some have hybrid roles, such as Technical & Marketing).

2) Nutraceutical segments showing growth in recent years

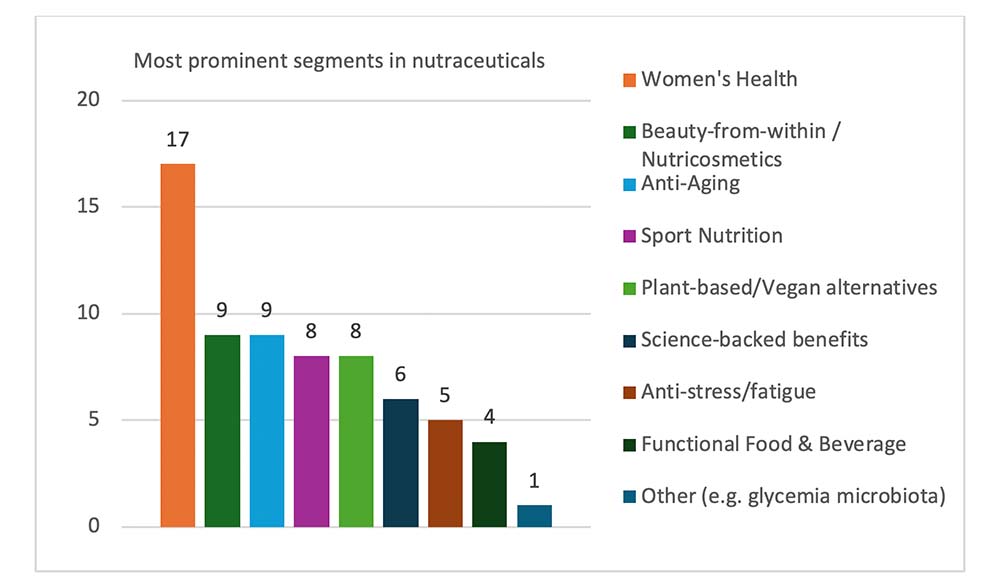

The most prominent segment in nutraceuticals, as selected by the interviewees, is women’s health, (37% of responses). This segment includes a range of products tailored to support women’s specific health needs, including supplements for hormonal balance, bone health, prenatal care, and menopausal support.

Following are beauty-from-within/nutricosmetics and anti-aging solutions, each representing around 20% of selections. Several factors can be attributed to the growing of these segments such as: increasing awareness among women about proactive health management, unique health needs throughout different life stages, empowerment, and self-care, among others.

Other segments selected by interviewee also relevant are sport nutrition and plant-based/vegan alternatives each representing 17% of the responses. Sport nutrition products are designed to enhance athletic performance, support muscle recovery, and optimize energy levels. Plant-based and vegan alternatives offer consumers ethical and sustainable options, supplying the growing demand for plant-based diets.

3) Raw materials in trend: insights from Interviewees

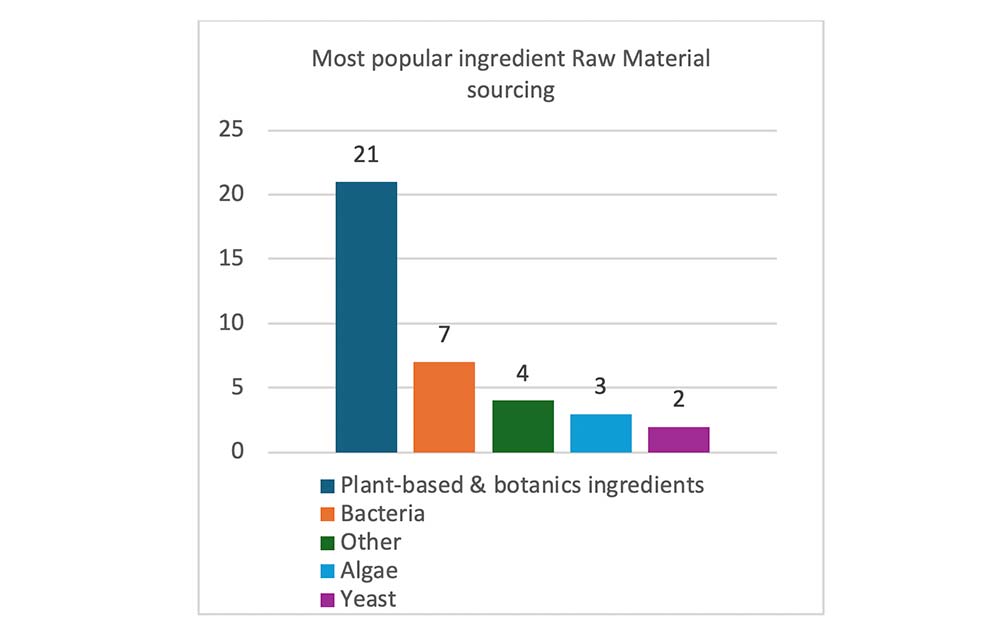

The raw material sourcing chosen for more than a half of the interviewees is plant-based & botanical ingredients (approximately 54%), followed by bacteria (18%). Each segment plays a crucial role in product formulation and addresses specific consumer preferences and trends.

Plant-based & botanical ingredients are preferred for their natural origins and health benefits offering sources of vitamins, minerals, antioxidants, and phytonutrients. The increasing popularity of plant-based diets and the growing awareness of sustainability contribute to the rising demand for these ingredients, driving manufacturers to incorporate these ingredients into their products.

Bacteria-based ingredients, including probiotics and other microbial strains, have gained attention for their potential to promote gut health. The increasing scientific research highlighting the importance of gut health has also raised the demand for bacteria-based ingredients. As consumers become more proactive about managing their health, they are seeking products that support a healthy gut ecosystem, leading to the growing use of bacteria-based ingredients in nutraceutical formulations.

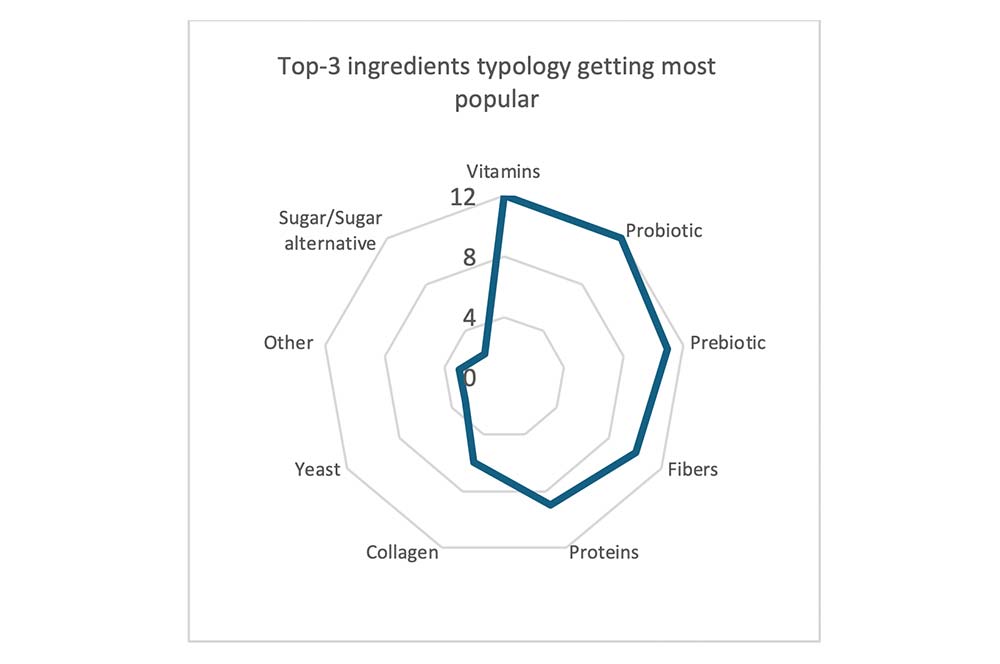

4) Product formulation: top-3 nutraceutical leading ingredient by interviewees

Vitamins, probiotics & prebiotics are the ingredients getting most popular followed closely by fibers, and proteins. Vitamins are essential for their role in supporting overall health and immunity. Probiotics and prebiotics, known for their gut health benefits, have gained popularity due to increasing awareness of the importance of a healthy microbiome. Fibers, and proteins are also highly regarded for their digestive health and satiety benefits.

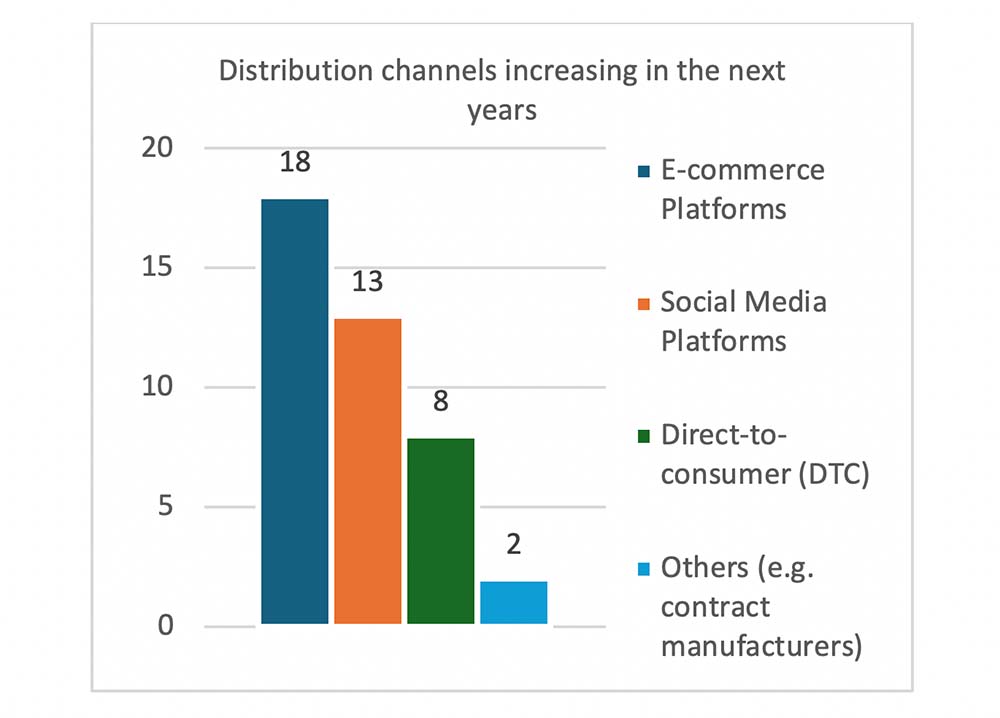

5) Interviewee predicts rise in digital distribution channels

In the past years, distribution channels have undergone significant diversification and are projected to grow in the future.

E-commerce platforms emerged as one of the most preferred ways for product distribution followed by social media platform, both channels are expected to grow in the coming years. In fact, forecasts suggest a double-digit growth rate for these platforms,

The increasing influence of social media and e-commerce platforms can be attributed to several factors. Firstly, the widespread adoption of digital technologies has impacted the consumer behavior, with more people using online platforms for their shopping. The advantage of purchasing products from the comfort of home has increased the popularity of e-commerce platforms.

Secondly, social media platforms (TikTok, blogs, Insta…) have evolved beyond mere communication tools to become powerful marketing platforms. With billions of active users worldwide, social media allows marketing strategies through influencer partnerships.

Additionally, the COVID-19 pandemic has accelerated the adoption of e-commerce as lockdowns and social distancing measures forced consumers to shift their purchasing behavior online.

Even as restrictions have eased, consumers have kept online shopping and most participants foresee the number only growing in the future.

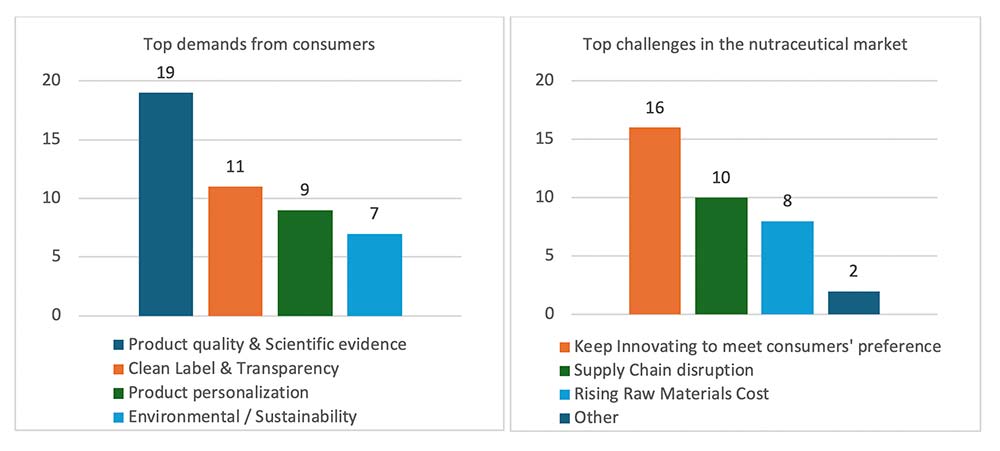

6) Top demands and challenges in the nutraceutical market identified by the interviewees

The primary consumer demands highlighted by interviewees is product quality & scientific evidence (41%), clean label transparency (24%) and followed closely by product personalization (20%). Notably, while environmental sustainability remains an important topic within the nutraceutical industry, it does not rank as one of the main demands among consumers.

This shift in consumer demands can be attributed to several factors. Firstly, the awareness and access to information have empowered consumers to prioritize factors such as product quality & scientific evidence when making purchasing decisions. Secondly, as consumers become more informed, clean label transparency has gained significance. Information regarding sourcing, production methods and ethical practices are very importance when choosing products.

One of the key challenges in the nutraceutical market voted by several of the interviewee is the ongoing need for innovation to meet changing consumer preferences. This increased focus on innovation is driven by the ever-evolving tastes and preferences of consumers. Additionally, supply chain concerns have become more important since the COVID-19 pandemic. Globalization and disruptions in the supply are two major challenges followed by the raw materials cost increase.

7) Our conclusion

The nutraceutical industry is changing in response to shifting consumer preferences and trends. Interviewees highlighted the rise of women’s health products, plant-based ingredients, and E-commerce platforms. Quality & scientific evidence remain key to consumers. However, challenges like supply chain management and innovation to meet consumer needs are still present. Success in this dynamic requires companies to adapt quickly, prioritize consumer centric strategies and keep up with digitalization and new channel-to-market to maintain close contact with the consumers.