Introduction

Low-altitude economy (LAE) refers to a comprehensive economic form in which civil manned and unmanned aircraft are used as carriers to drive the integration and development of related fields, generally <1,000 meters in vertical height.

The low-altitude economy lies in integrating aircraft with diverse industries and expanding its application scenarios, which can be summarized as “LAE+”, such as “LAE+ Agriculture & Forestry”, “LAE+ Electricity”, “LAE+ Logistics”, “LAE+ Medical”, “LAE+ Tourism”, “LAE+ Transportation”.

The LAE upstream and midstream industries overlap significantly with the well-developed civil aviation and new energy vehicle sectors, giving the “low-altitude economy” a solid foundation for growth.

In this article, Daydream shows opportunities for the chemicals market in LAE from 3 aspects: market size, key materials, value chain & key players with a Chinese focus in 2024.

Table of content

1. LAE Market Size

a. Market Size

b. Illustration

2. Key Materials

a. Lightweight Composites

b. Alloy

c. Battery

3. Value Chain and Key Players

a. Value Chain for LAE aircraft

b. Materials Key Players – Illustration

c. Other Key Players: Administration and Policy

4. Daydream

5. References

1. LAE Market Size

a. Market Size

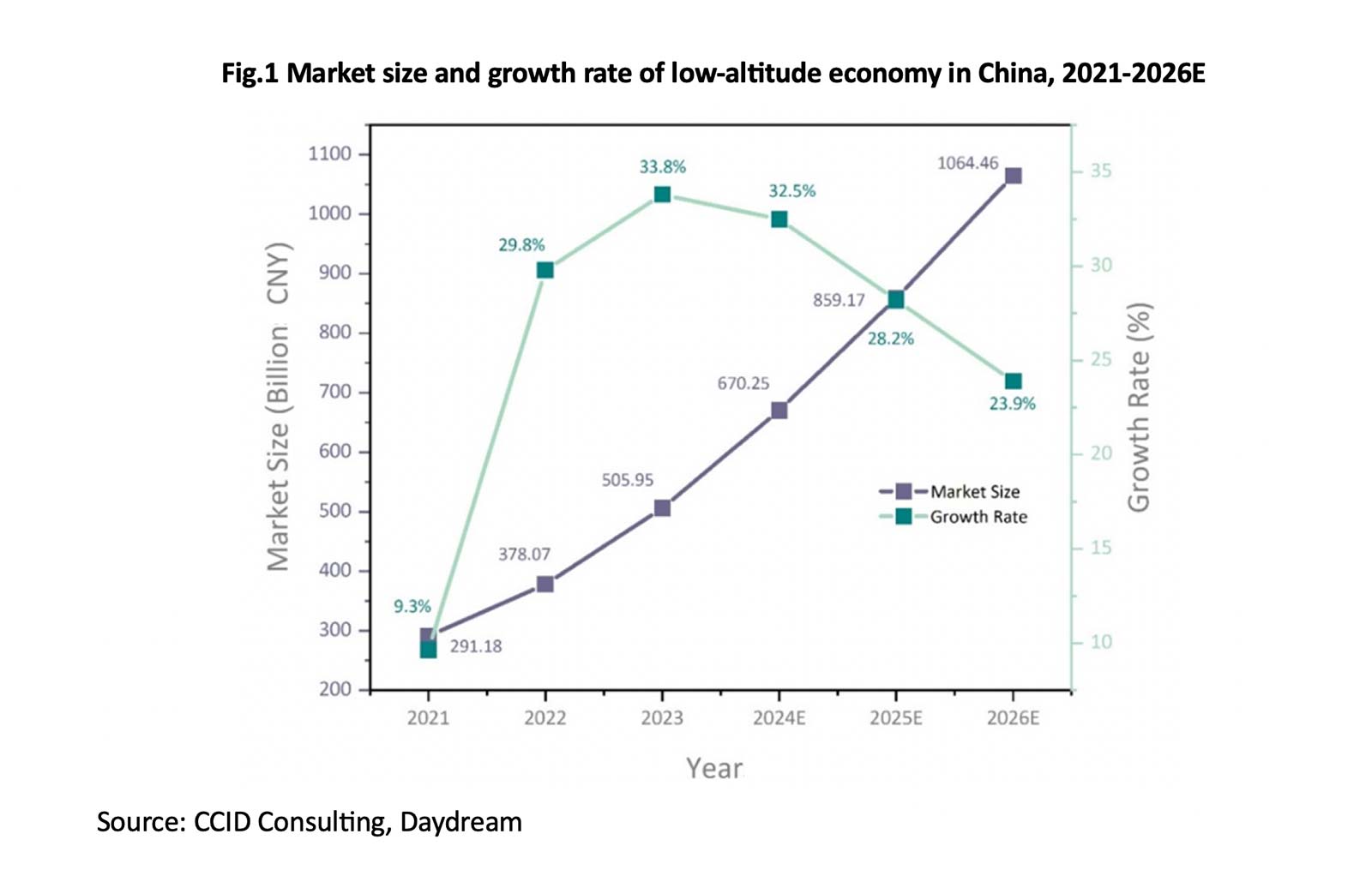

In China, the Chinese LAE market size continued to grow since 2021 and was projected to reach 1,064 billion CNY by 2026 (139.8 billion EUR) with annual growth rate of 24-34%.

b. Illustration

On February 27th, 2024, the Electric Vertical Take-off and Landing Aircraft (eVTOL) completed its first inter-city electric air-taxi demonstration flight in Guangdong province in China, reducing the travel time between Shenzhen and Zhuhai from about 2 hours by road (~107 km) to just 20 minutes.

Besides China, other countries and regions are also actively developing the low-altitude economy, for example:

- USA: an operational validation flight of the Alia 250 eVTOL was completed in February 2023 through a collaboration between Blade Air Mobility and Beta Technologies. Blade has ordered 20 Alia 250 and plans to use them to connect JFK International Airport with Manhattan in the future, providing passengers with convenient air transportation.

- Several European countries encourage the research and application of eVTOL technology through measures such as directly funding research projects and establishing special funds or grants, for example,

- Berlin (Germany): Urban Air Mobility Project – The Berlin government is actively collaborating with multiple eVTOL manufacturers and operators to promote the development of urban air mobility.

- Paris (France): Vahana Project – The Paris region cooperates with aerospace giants such as Airbus, to advance the R&D and test of eVTOL.

2. Key Materials

For chemicals, the main opportunities brought by the low-altitude economy are primarily concentrated in the field of “lightweight and high-strength materials”. These materials offer advantages of reduced weight, superior strength and good toughness versus conventional materials, which provide more possibilities for the design and manufacturing of aircraft.

a. Lightweight Composites

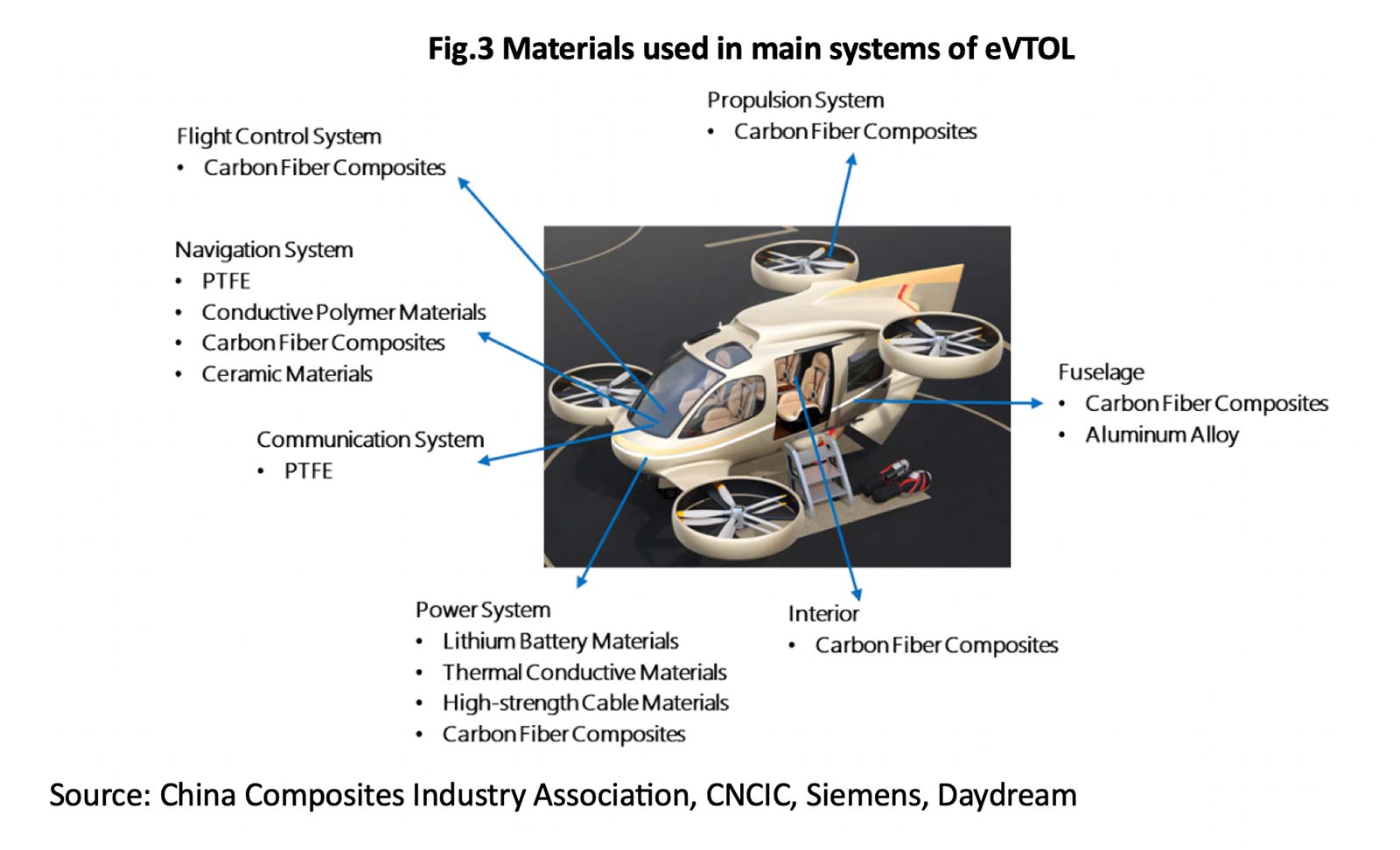

- Lightweight composites are commonly used in all categories of products in the low-altitude economy, especially in the structural systems of drones and flying cars.

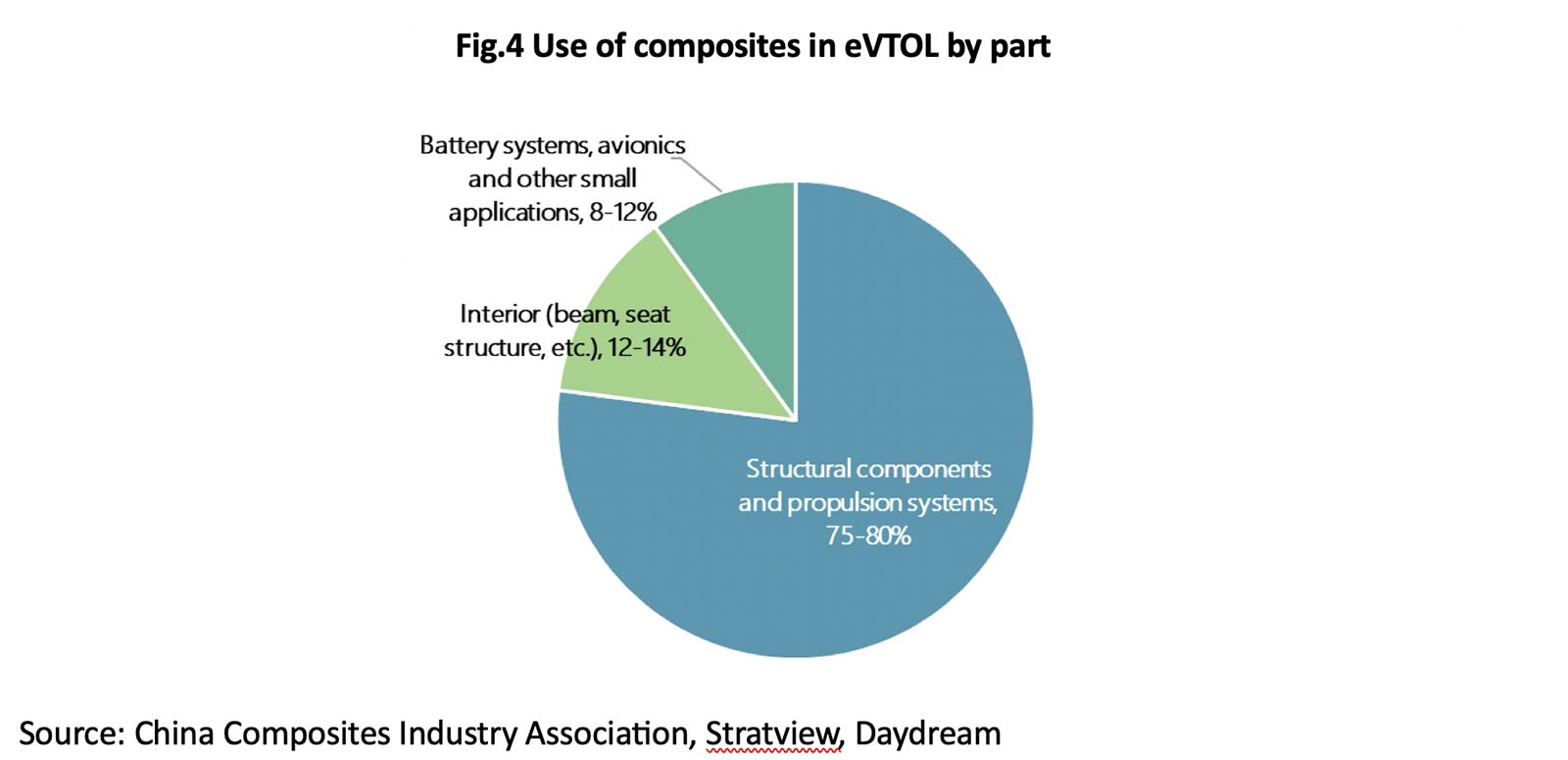

- It is estimated that in an eVTOL, the volume of composites needed accounts for over 70% share of total materials used. And among the composites used, 75-80% are used in the structural and propulsion systems.

- Reinforced fibers and matrix resins are the two main compositions in composites

- Reinforced fibers: In a flying car, over 90% of the composites are reinforced with carbon fiber, while the remaining 10% use glass fiber.

- It is estimated by Topsperity Securities that the carbon fiber demand for a single eVTOL ranges between 100 and 400 kilograms.

- In 2023, production volume of carbon fibers in China was around 55,000 tons, with a year-on-year increase of 14.8%. China imported 16,000 tons of carbon fiber products in 2023, with a significant decrease of 45.4% compared to the previous year.

- In terms of production scale, Chinese carbon fiber producers have ranked among the top after years of continuous capacity expansion, but the industry in China is facing issues such as severe shortage of high-end products, high costs for mid-range products and overcapacity of low-end products. The carbon fibers are mostly concentrated in T300 and T700 grades, with a clear shortage of high-performance products including T800 and above grades.

- Matrix resins:

- Thermoset: composites with thermoset (mainly epoxy) are currently the major solutions applied by aircraft manufacturers in low-altitude industry for parts like fuselage, as these composites have been used in the aerospace industry for many years.

- Thermoplastics: composites with thermoplastics (e.g., PA, PEEK) now are primarily used in relatively small parts, such as rotor systems (e.g., propeller blades) and brackets. These thermoplastics can help guarantee the stability of aircraft (e.g., drones) in extreme or complex environments (e.g., high temperatures and high humidity) over a long period of time.

- Reinforced fibers: In a flying car, over 90% of the composites are reinforced with carbon fiber, while the remaining 10% use glass fiber.

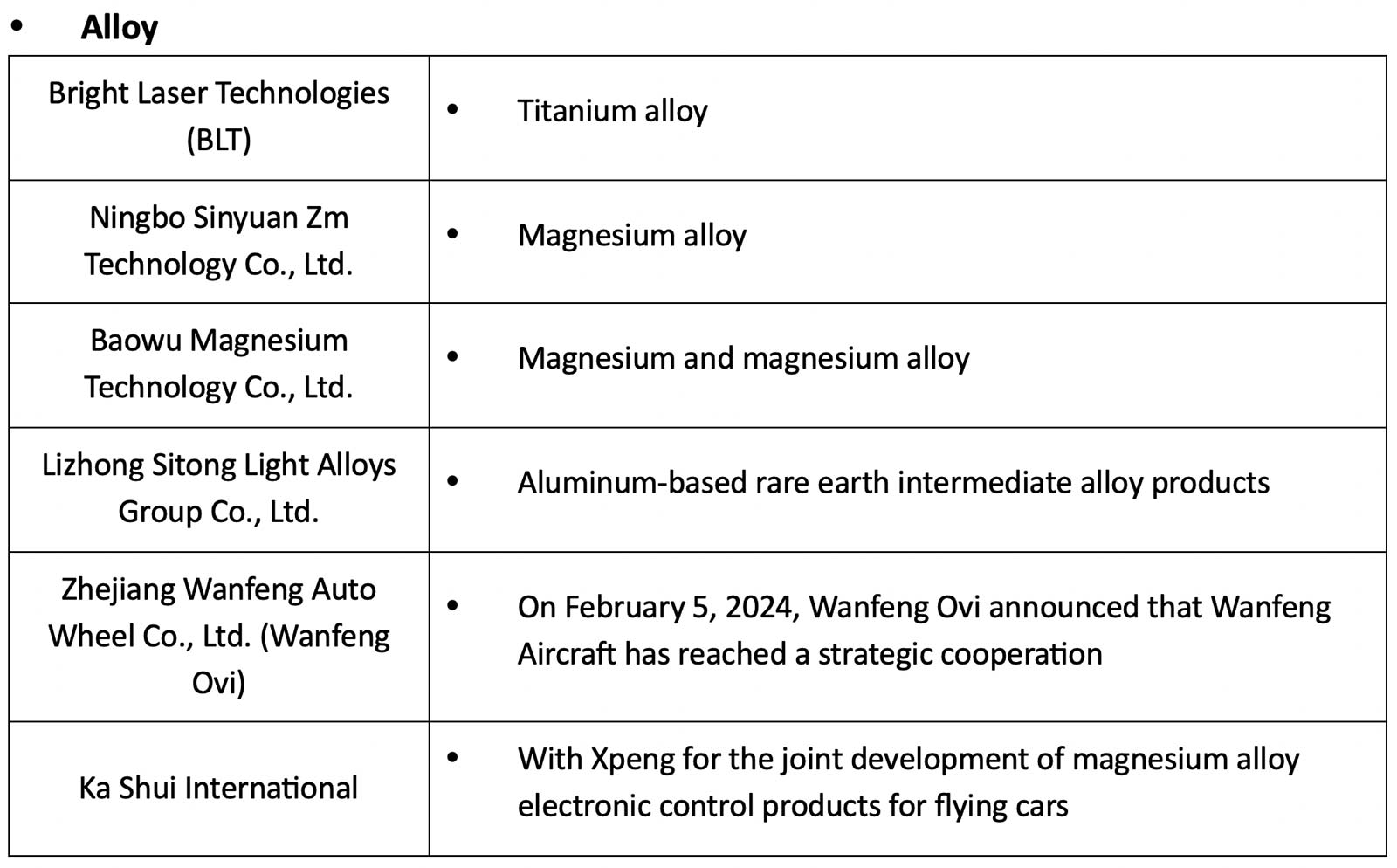

b. Alloy

- Titanium alloy

- Titanium alloy is reported as the potential solution for fasteners in flying cars owing to its high strength and light weight. It is estimated by Everbright Securities that demand volume of Titanium alloy could be 75.6 kg per flying car.

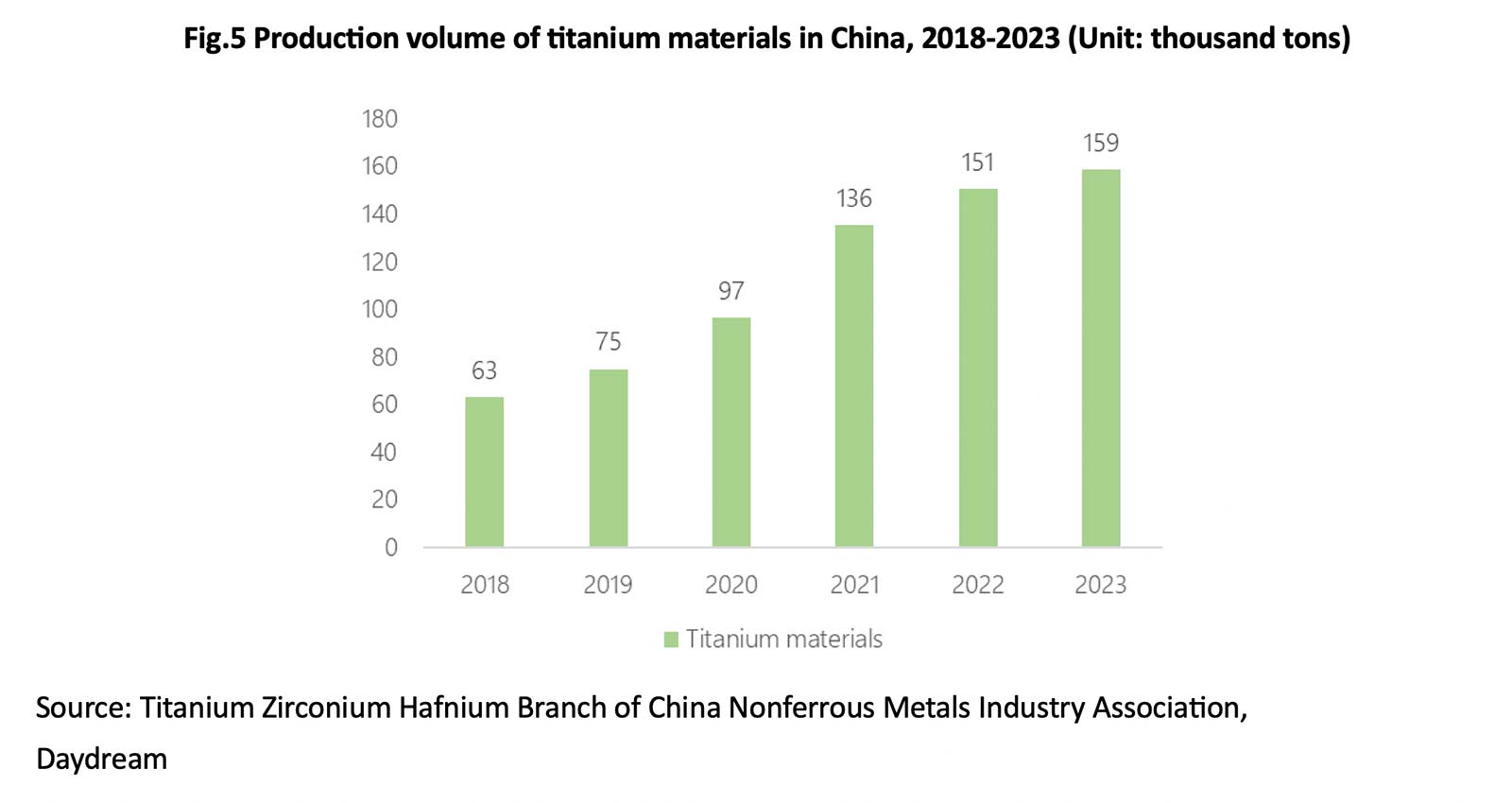

- In the past few years, China’s Titanium materials industry has experienced rapid growth, with titanium materials production reaching 159,000 tons in 2023, growing at CAGR (Compound Annual Growth Rate) of 20.2% in 2018-2023.

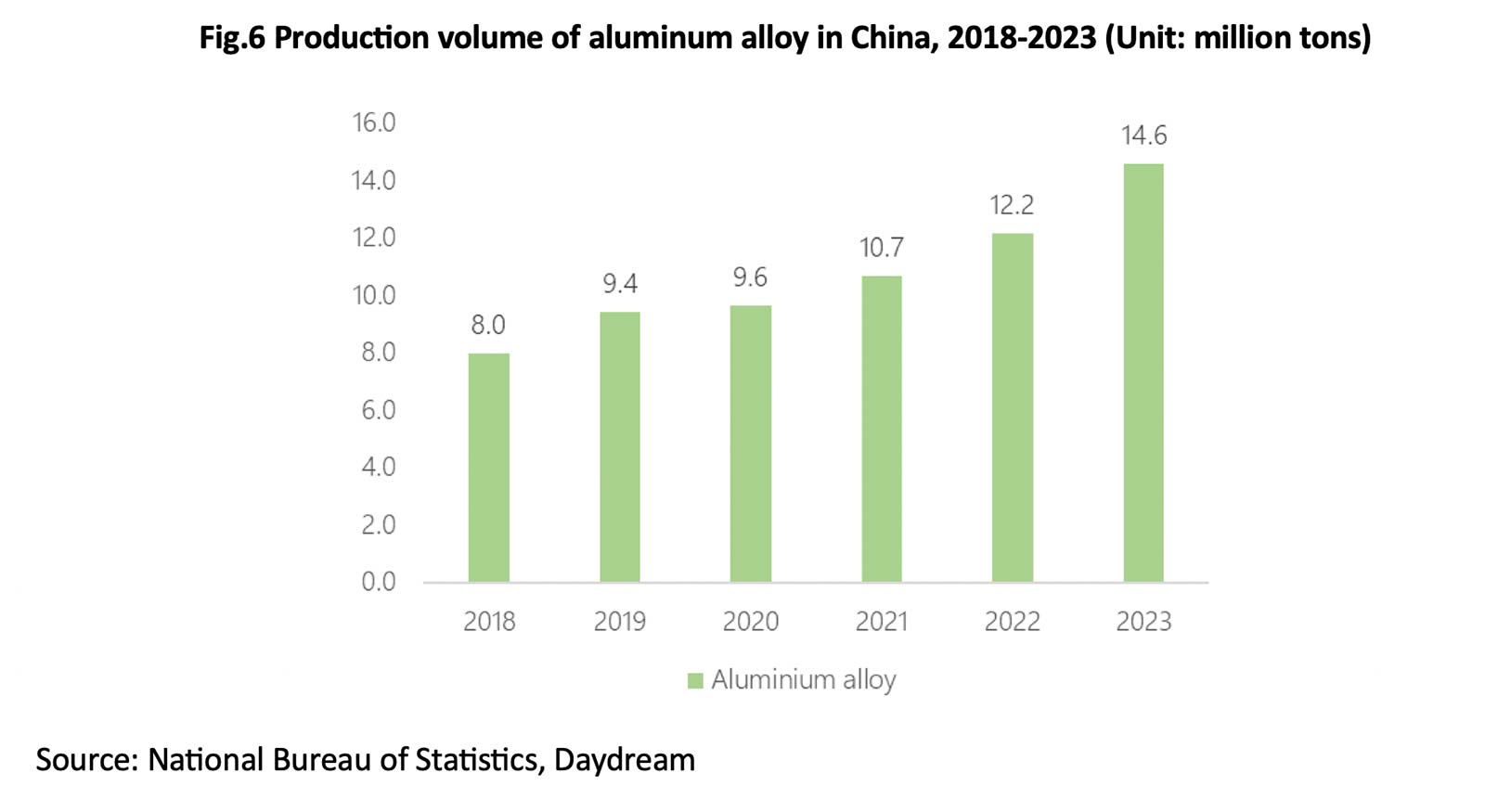

- Aluminum alloy

- Aluminum alloy has been widely used in the aerospace market due to its advantages such as lightweight, high strength, corrosion resistance, fatigue resistance. With continuous advancements in aluminum alloy forming and processing technologies, the material’s performance is steadily improving, making it well-positioned in the low-altitude economy as companies continue leveraging its typical advantages (e.g. light weight).

- Production volume of aluminum alloy in China reached 14.6 million tons in 2023, growing at 19.7% compared to 2022.

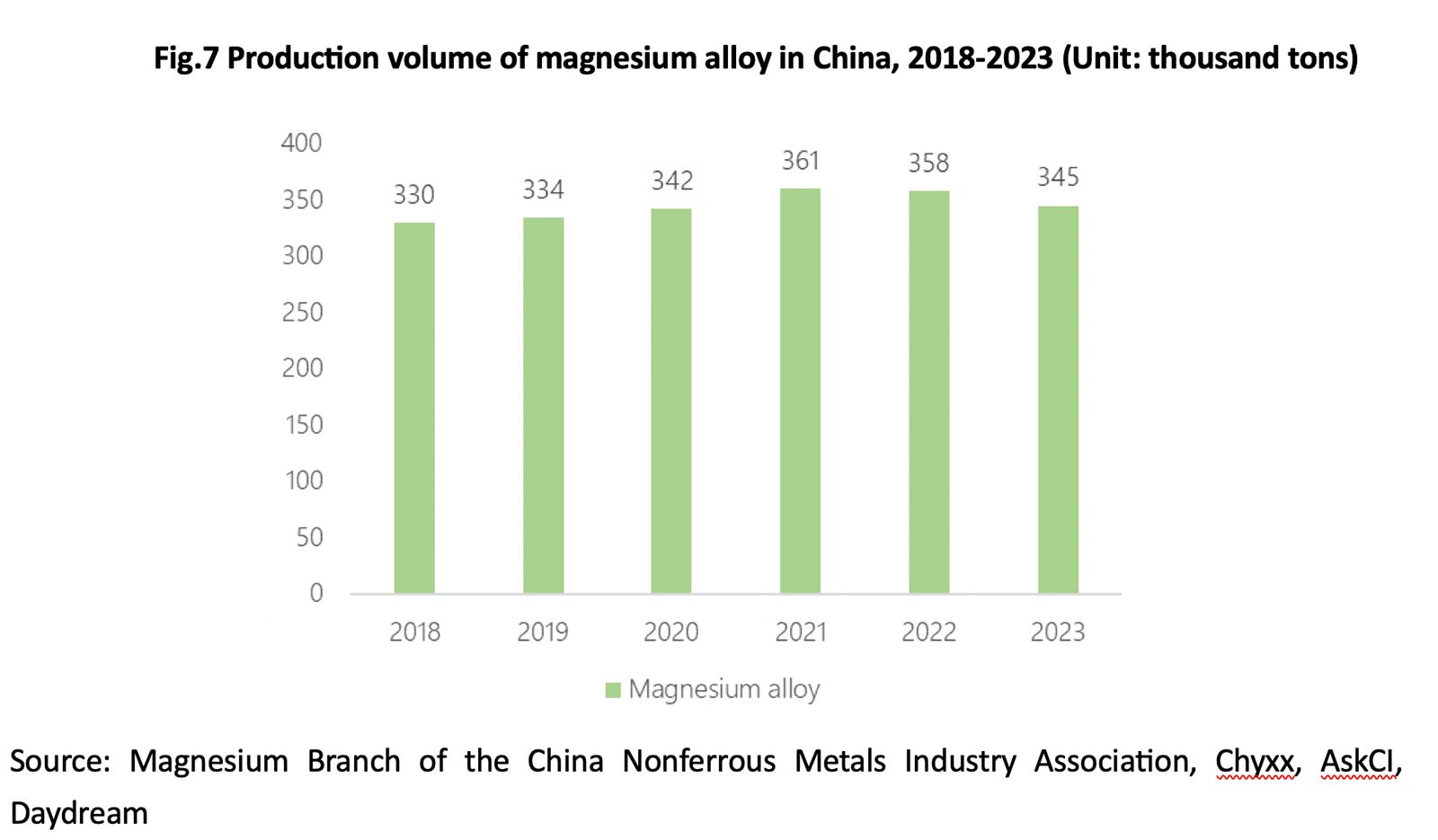

- Magnesium alloy

- Use of magnesium alloy can help reduce the weight of aircraft. Current research on the use of magnesium alloy in aircraft includes magnesium alloy die-casting for electronic control products, large-scale die-casting of ultra-large magnesium alloy components etc. It is estimated by Everbright Securities that demand volume of magnesium alloy could reach 10 kg per flying car.

- The doping of rare earth elements can effectively enhance the mechanical and heat-resistant properties of magnesium alloys.

- For example, critical components such as the rear reduction gear casing of helicopter engines and the wing ribs of fighter jets are made from the ZM6 alloy — one of the three main series of cast magnesium alloys known as “magnesium-rare earth metal-zirconium alloys”. This high-strength, heat-resistant magnesium alloy primarily uses neodymium as the main alloying element.

- Production volume of magnesium alloy in China was 345,200 tons in 2023 with a decrease of 3.5% compared to 2022.

In addition to material demands driven by requirements for light weight and high strength, some equipment and materials already used in well-developed industries, such as electric vehicles, have also been applied to low-altitude aircraft. For example,

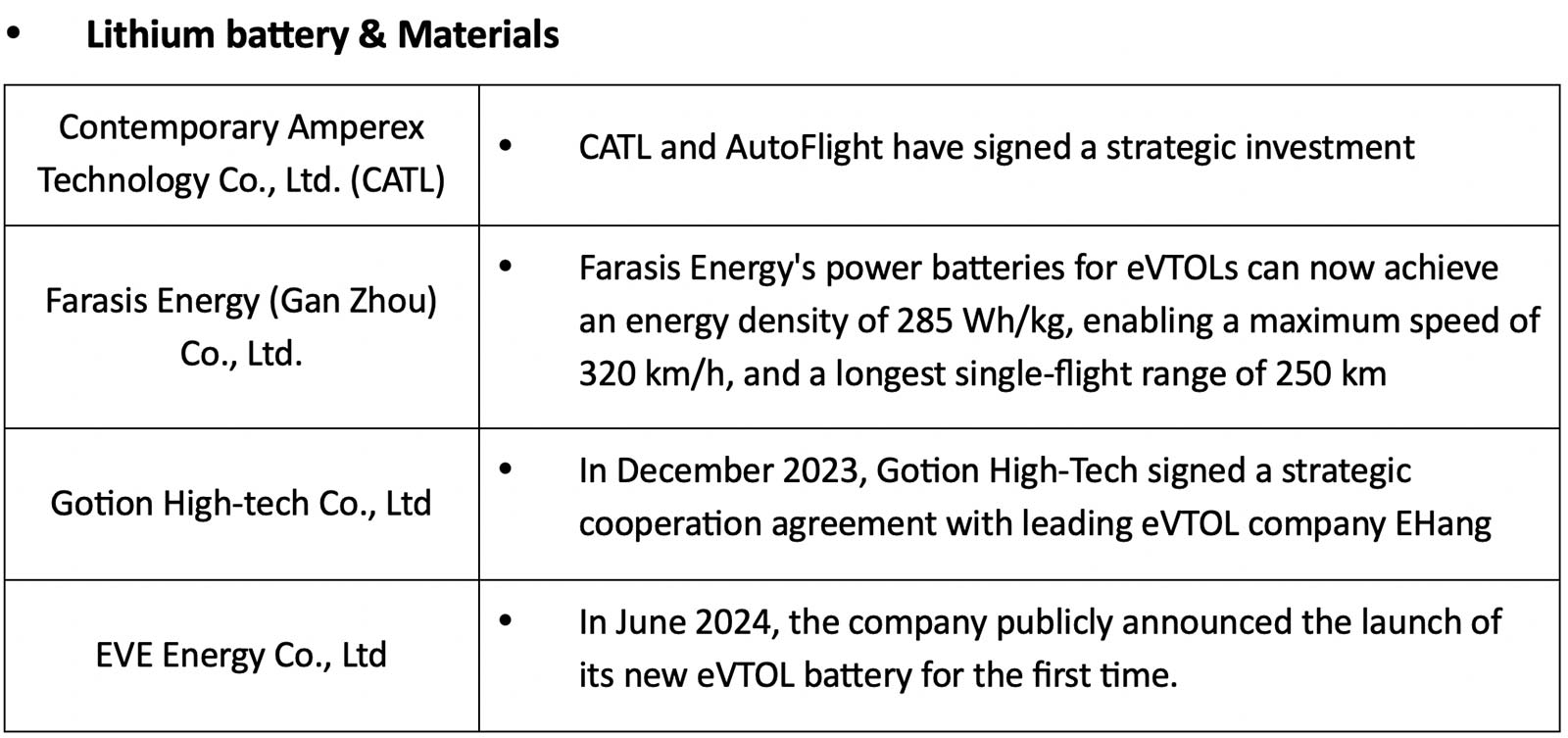

c. Battery

- Lithium Battery Materials

- The LAE can be viewed as a “vehicle-based” economy, where the power system serves as the heart of it. A robust power system relies on energy storage materials, especially high-energy-density lithium-ion batteries and emerging battery technologies in development. These provide reliable power for electric aircraft and expand the growth potential of lithium battery materials within the low-altitude economy.

- Current batteries for electric aviation include condensed batteries (CATL), cylindrical batteries (Weilan Lithium, Zhengli New Energy, Gotion High-Tech, etc.), pouch batteries (Farasis Energy, etc.), and solid-state batteries (Inx, Enli Power, Solid Energy Systems, etc.).

- The LAE can be viewed as a “vehicle-based” economy, where the power system serves as the heart of it. A robust power system relies on energy storage materials, especially high-energy-density lithium-ion batteries and emerging battery technologies in development. These provide reliable power for electric aircraft and expand the growth potential of lithium battery materials within the low-altitude economy.

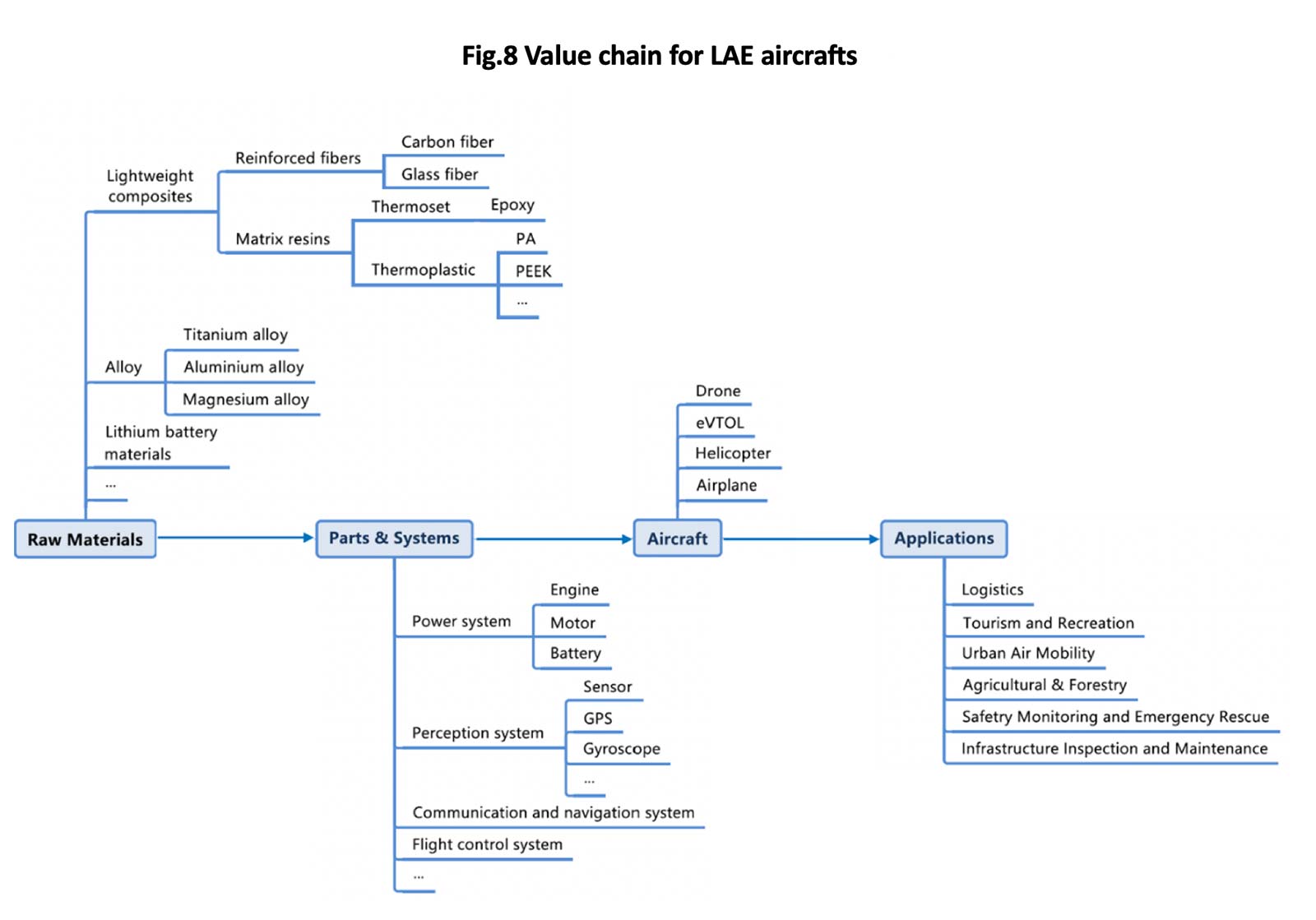

3. Value Chain and Key Players

a. Value Chain for LAE aircraft

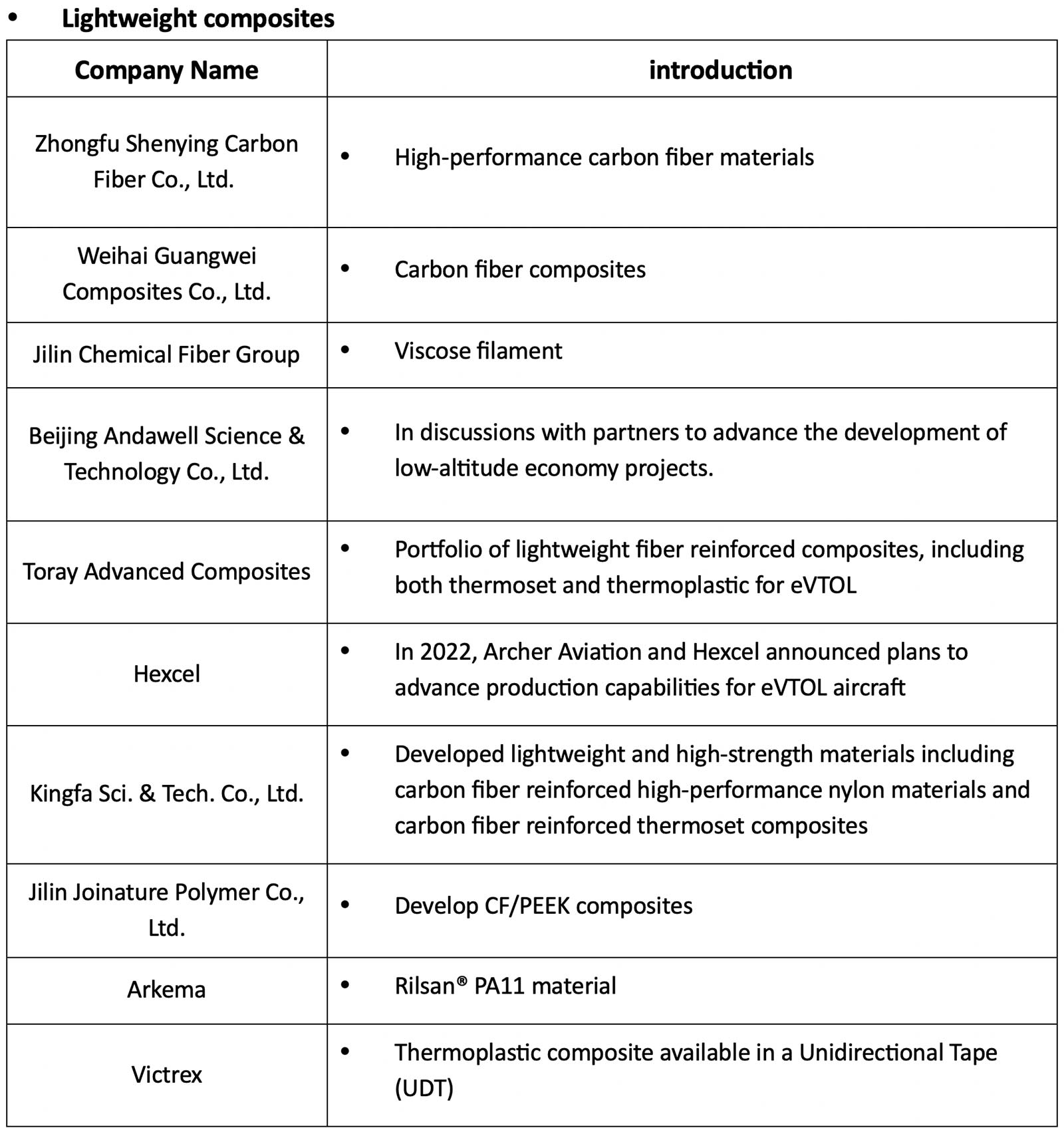

b. Materials Key Players – Illustration

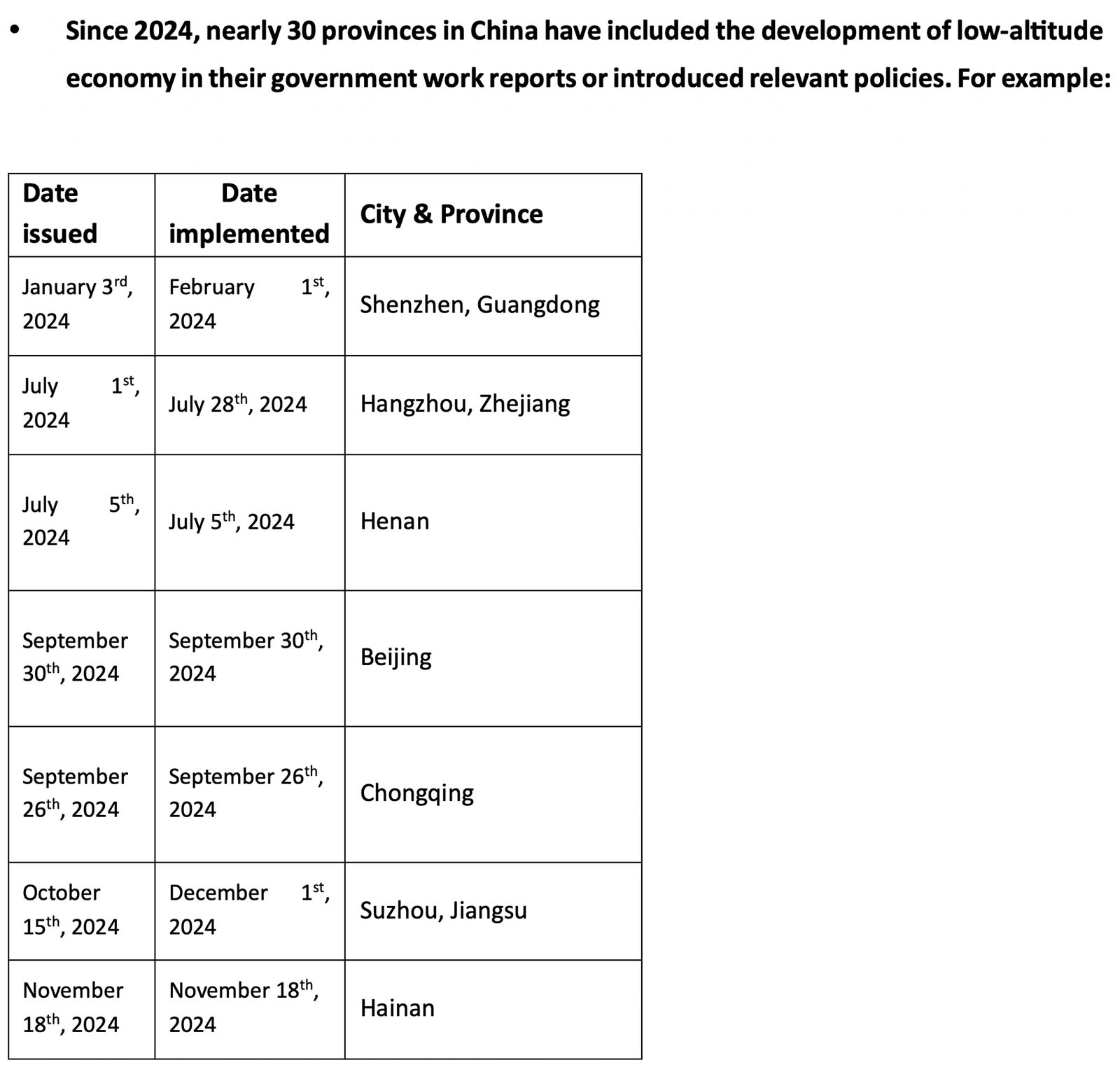

c. Other Key Players: Administration and Policy

In recent years, to promote the rapid growth and healthy development of the low-altitude economy in China, several policies and regulations have been introduced at both national and provincial level, which not only provide the policy support and a legal framework, but also drive the technology innovation within the industry and the expansion of application scenario.

4. Daydream

To continue this work of understanding the market, estimating volume and technical needs, defining your strategy, and developing your business in Asia, Europe, and the USA, contact us for an appointment:

- Asia: chen@daydream.eu

- USA: lorini@dynovel.com

- Europe: jean-louis.cougoul@daydream.eu

5. References

- China low-altitude economy development research report (2024), CCID Consulting

- Trillion-dollar low-altitude market: Which materials will benefit?, Qizhanyun

- Low-altitude economy to explode? Four types of new materials, including carbon fiber, are ready to emerge, Supply chain platform for compound material collection

- Brief discussion on low-altitude economy and Aluminum alloys, China Nonferrous Metals News

- One day to fully understand an industry chain: Low-altitude economy, Fei Pao de Lu

- Development status and future trends of low-altitude economy industry in China and overseas, Shenzhen Aviation Industry Association

- Opportunities for composite in air mobility-eVTOL, China Composites Industry Association

- Composites in Aerospace – How eVTOLs May Change the Future of Transportation, Composites One

- Zhongtou Consultant’s Opinion: Analysis of the advantages and development status of typical companies in the global low-altitude economy sector, China Investment Corporation (CIC), investment advisor

- Zhongtou Consultant’s Opinion: Comparative analysis of low-altitude economy (eVTOL) industry clusters in China and overseas, China Investment Corporation (CIC), investment advisor

- Zhongtou Consultant’s Opinion: Investment opportunity analysis in the Electric Vertical Takeoff and Landing (eVTOL) industry chain, China Investment Corporation (CIC), investment advisor

- New field for carbon fiber – Low-altitude economy prepares to take off, Topsperity Securities

- How does demand from flying cars drive metal material needs, Everbright Securities

- Low-altitude economy continues to develop, Magnesium materials expected to unlock path to low-altitude commercialization, Hwabao Securities

- Time for carbon fiber leaders to experience a second growth, Guolian Securities

- The development prospects of the low-altitude economy are promising, Policy Simulation Laboratory of the Economic Forecasting Department, National Information Center