Summary

1. How will COVID-19 impact the Chemical Industry short and long term?

2. Profile of respondents

a. Position

b. Location

c. Industry

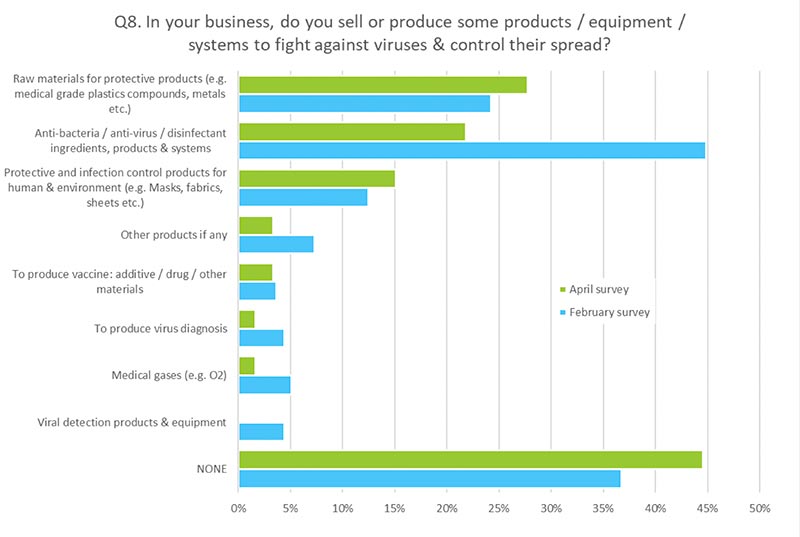

d. End-use market & products relevant to COVID-19

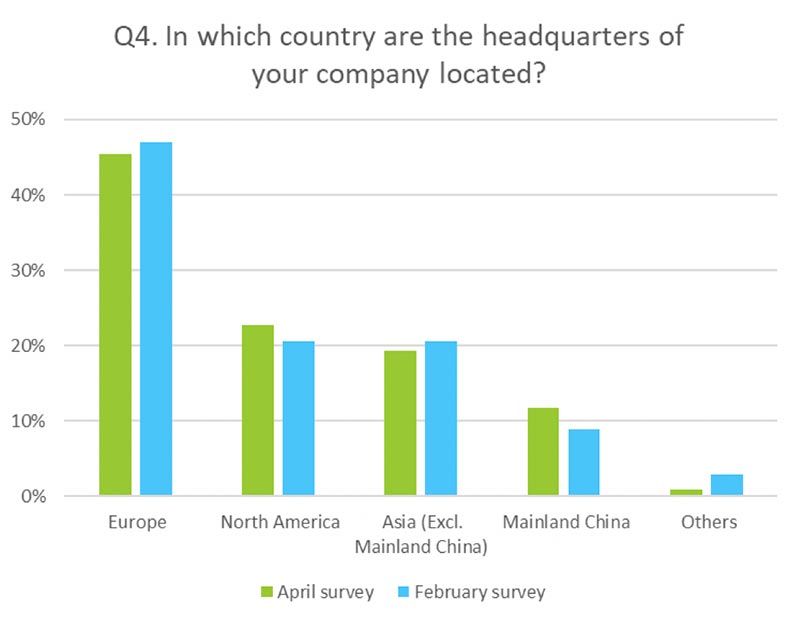

e. Location of HQ

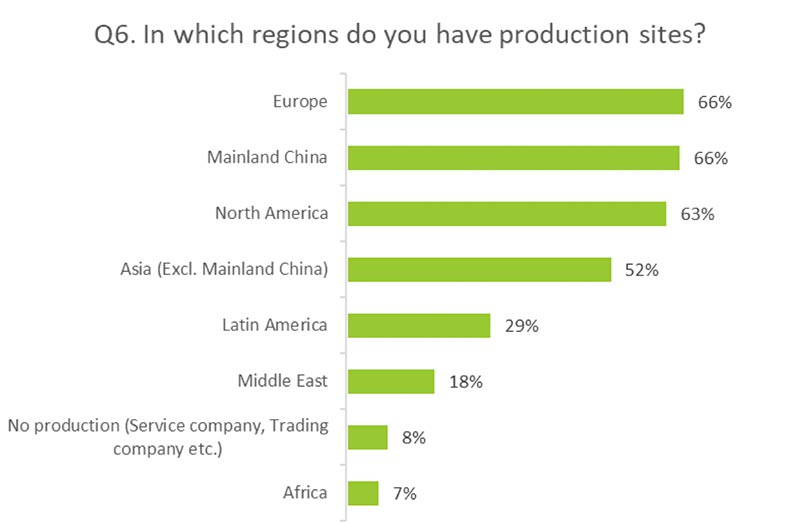

f. Location of Production

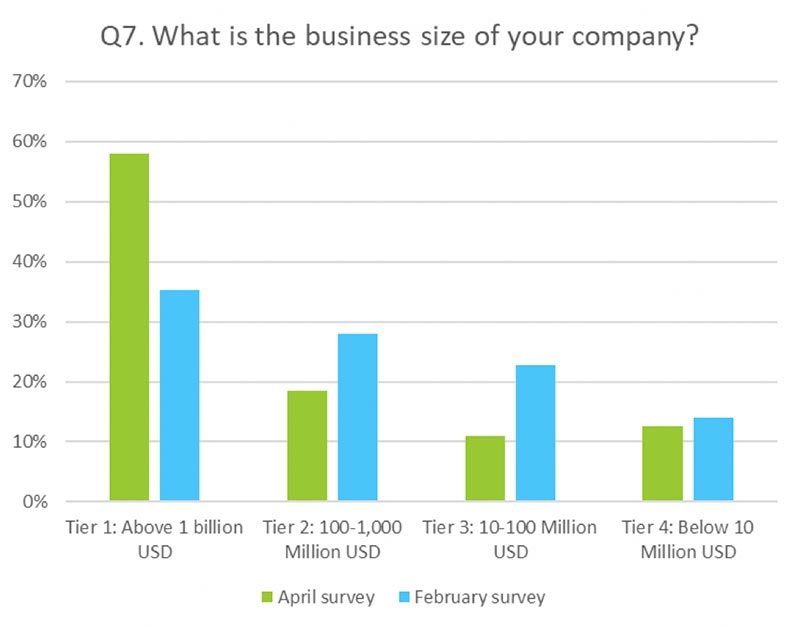

g. Business size

3. Expected time for companies’ operations to rebound to its level before COVID-19

a. By company size

b. By location of HQ

4. Expected time for country’s Industrial Production to rebound to its level before COVID-19

a. By location of respondents

5. How do you expect COVID-19 will impact your 2020 business (2020 VS 2019)?

a. By business size

b. By location of HQ

c. By end-use market

6. Short-term actions and long-term strategy to fight COVID-19

a. Short-term actions

b. Long-term strategies

7. Importance level of the questions/problems faced due to the current Coronavirus crisis

8. Conclusion

1. How will COVID-19 impact the Chemical Industry short and long term?

For the past few months, countries around the world have been taking steps to control the spread of disease across countries and regions. The production and supply chain of industries in each country as well as in the world are inevitably strongly affected by the COVID-19 pandemics.

Since COVID-19 continues to strongly affect the lives of millions of people around the world and have a huge impact on world economies, we have updated the survey we published on March 2020 to further understand the extent of this impact.

This second survey has been conducted by Daydream from April 20th to 29th, 2020 with a wide geographic scope, gathering and analyzing the opinions of practitioners in the chemical industry around the world.

The analysis below is based on the 120 responses collected during the period April 20-29th, 2020, primarily from senior executives, sales and marketing executives and other operational positions in chemical companies, and the feedbacks collected total (256) gives a statistically reliable point of views of the chemistry situation in April 2020.

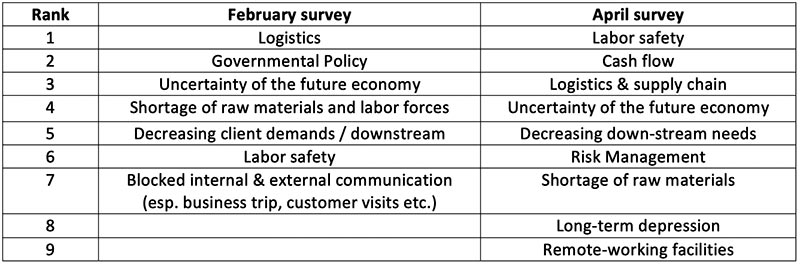

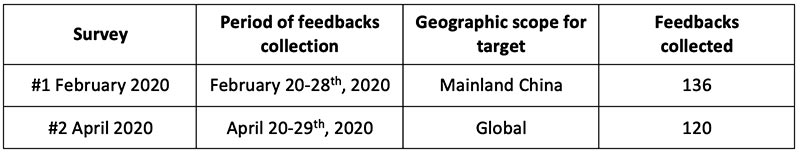

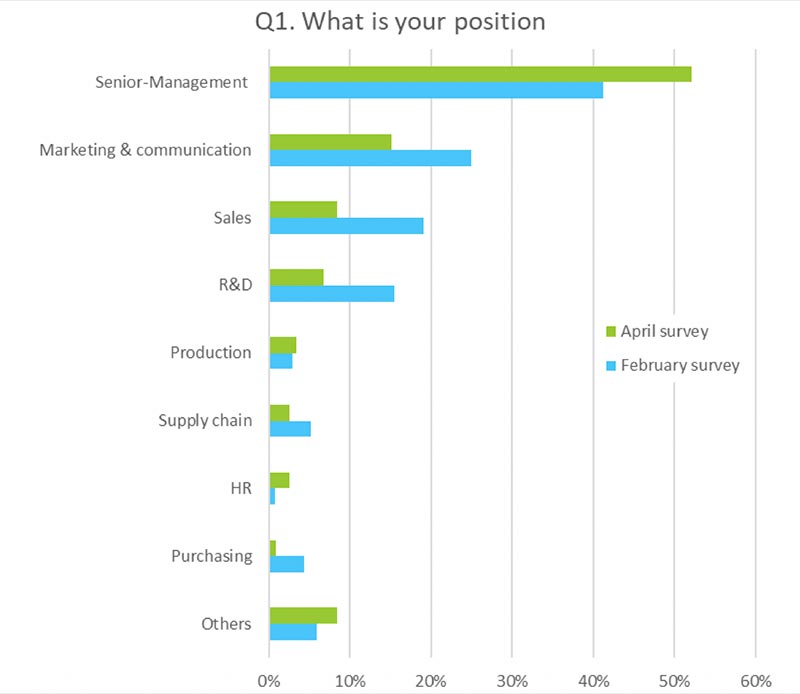

Daydream ran 2 anonymous surveys between February and April

Number of confirmed COVID-19, by date of report and region, Dec. 30th 2019 through May 17th 2020

2. Profile of respondents and end-markets served

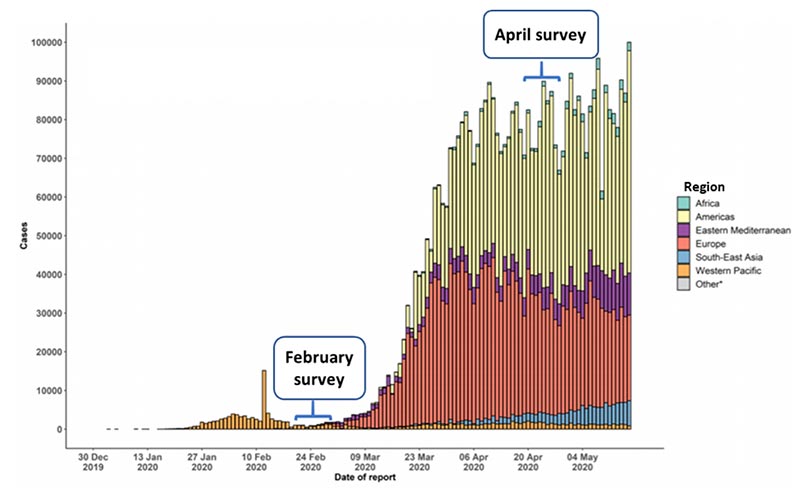

a. Position

More than half of the respondents are Senior-Management (Group Head, President, VP, General Manager, Department or Sector Director etc.), followed by Marketing & communication (15%), Sales (8%), and R&D (7%).

Proportion of respondents with position of Senior-Management in April survey increased by 10% compared with the one conducted in February.

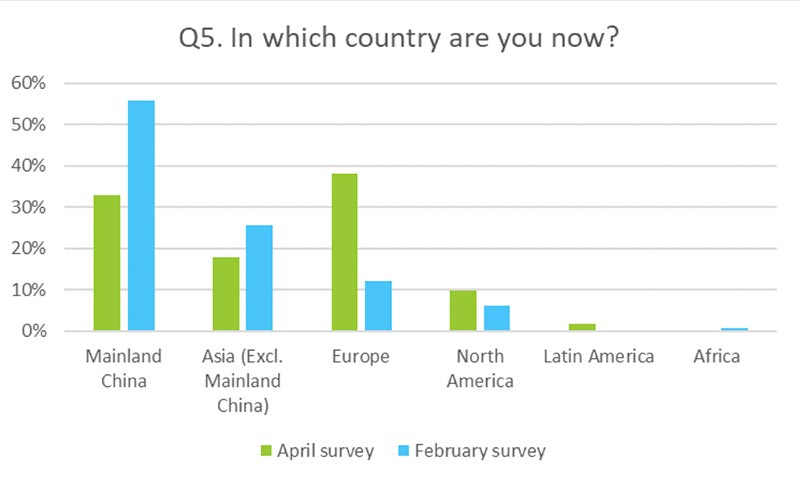

b. Location

In the survey of February, more than half of the respondents were located in Mainland China. While, in the survey of April, nearly 40% of respondents are in Europe, followed by Mainland China.

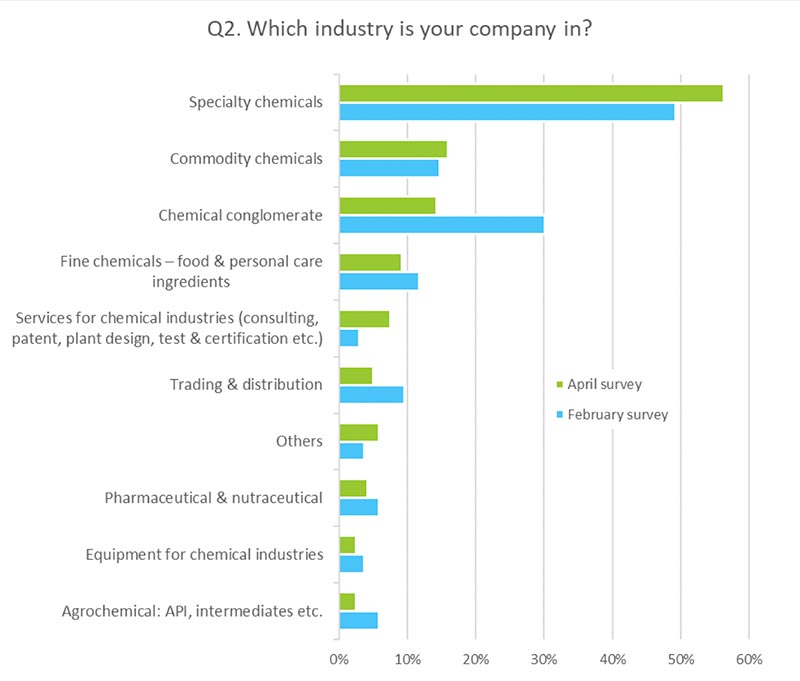

c. Industry

Respondents mostly come from Specialty Chemical companies in both of the 2 surveys (proportion of respondents are 49% and 56% in February and April survey respectively)

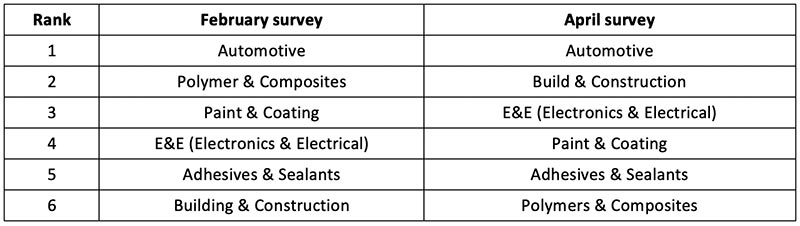

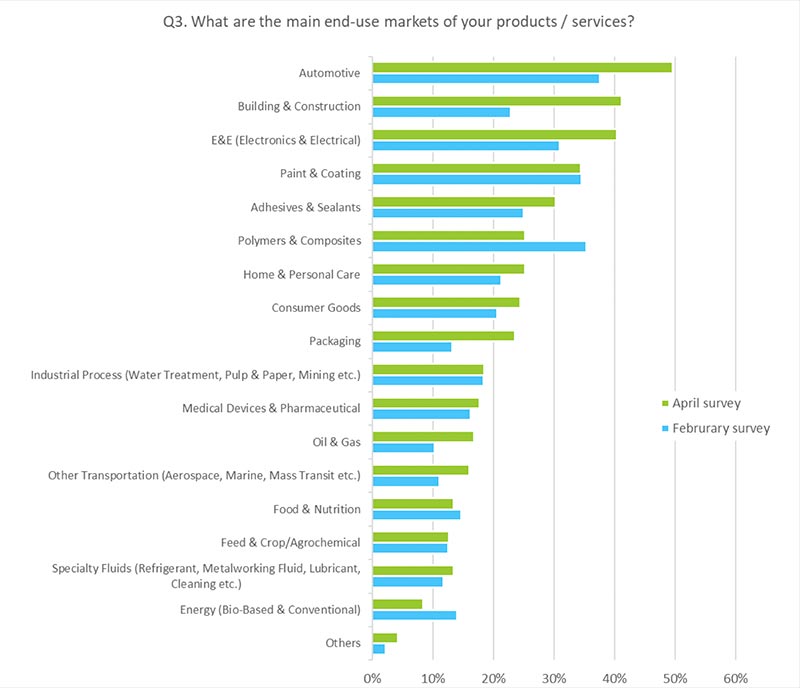

d. End-use market & products relevant to COVID-19

The 6 most important end-use markets of the respondents’ companies are:

In the survey of April 2020, 55% of the investigated companies sell products / equipment / systems to fight against viruses & control their spread. The breakdown of supplied products includes the following:

e. Location of HQ

No big difference between the distribution of headquarters location of respondents’ companies in the 2 surveys. Most of the participating companies have their HQ in Europe, followed by North America, Non-Chinese Asian countries, Mainland China and other regions.

f. Location of Production

g. Business size

Proportion of respondents from Tier 1 companies (business size above 1 billion USD) increased more than 20% in the April survey compared with the one ran in February.

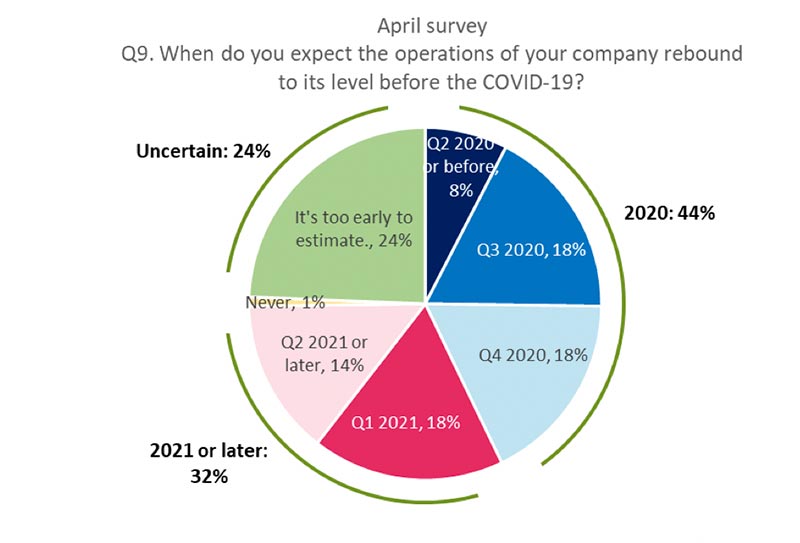

3. Expected time for companies’ operations to rebound to its level before COVID-19

In the April survey, 44% of the respondents expect a rebound of their production to its pre-COVID-19 level in 2020, 32% forecast that the production will recover in 2021 or later, while around 1/4 thought that the time for production recover is still uncertain now.

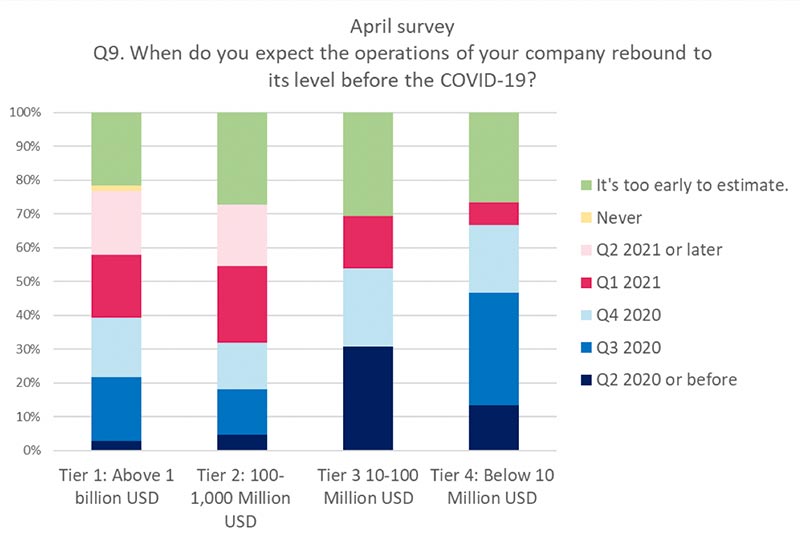

a. By company size

2/3 respondents in Tier 4 companies expect the operation of their companies recover in 2020, followed by Tier 3 companies (over 1/2 respondents expect). More respondents in Tier 1 and Tier 2 companies think that the recovery will achieve in 2021 or later.

20-30% respondents in each tier company thought that it is too early to make the estimation for business recovery now.

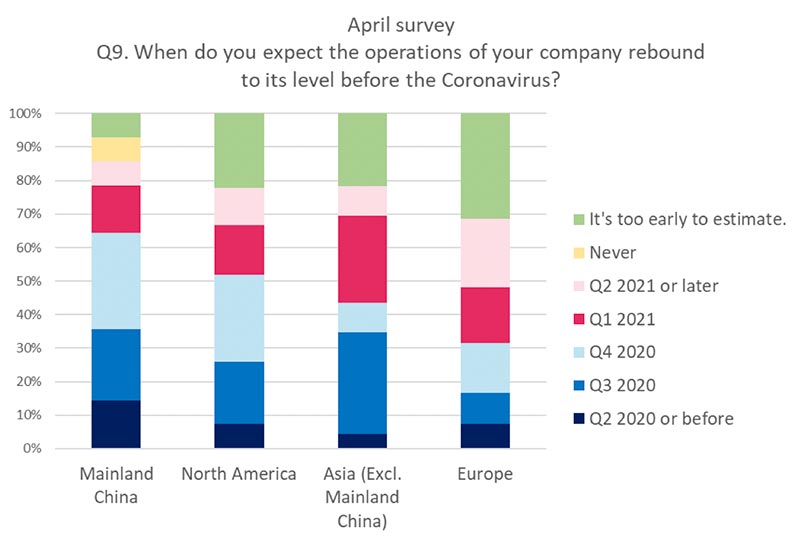

b. By location of HQ

In the April survey, strongest impact is expected by European companies, followed by Asian but non-Mainland Chinese companies. Nearly 70% respondents from European company foresee that the operation of their company will recover in 2021 or later, or it is too early to make the estimation now.

There is only 1 company headquartered at Africa in April survey, so it is not included in statistics to avoid bias

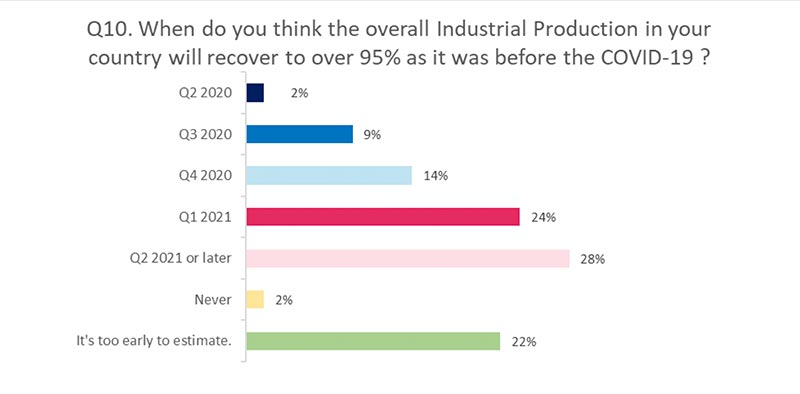

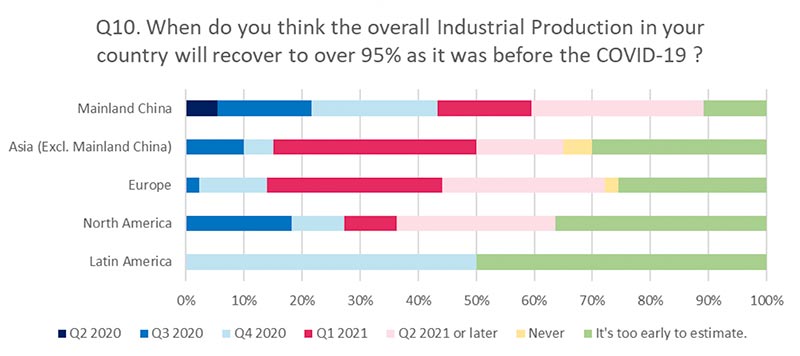

4. Expected time for country’s Industrial Production to rebound to its level before COVID-19

Over half of the respondents expects the recovery of overall industrial production in their country to over 95% as it was before COVID-19 in 2021 or later. While, 22% of them thought it is too early to make the estimation.

a. By location of respondents

More than 40% of the respondents located in Mainland China thought that the overall industrial production in Mainland China will recover to over 95% at it was before COVID-19 in 2020. While, majority of respondents located in Asia (Excl. Mainland China), Europe and North America thought that the recovery will occur in 2021 or later, or it is too early to estimate.

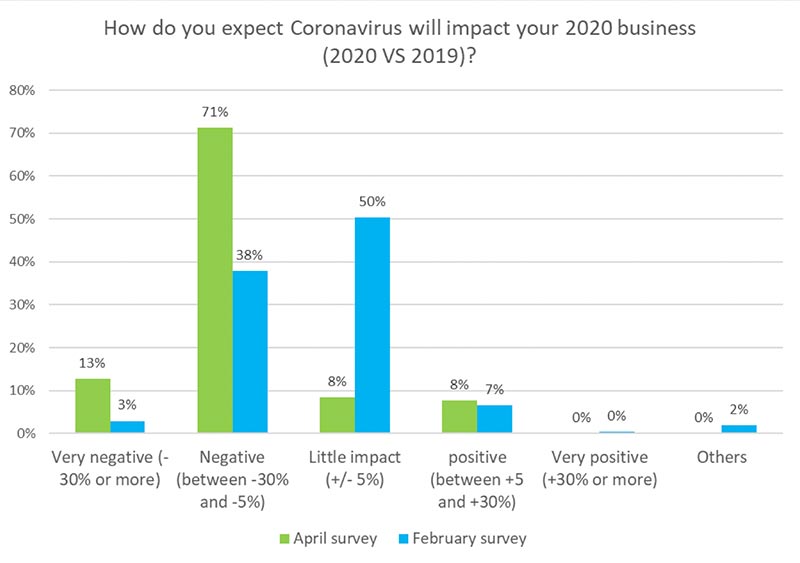

5. How do you expect COVID-19 will impact your 2020 business (2020 VS 2019)?

41% respondents in the February survey expected negative impact (very negative and negative) on their business in 2020, while this proportion doubly increased to 84% in the April survey. Proportion of respondents expecting positive impact remained at almost the same level 7-8% in the 2 surveys.

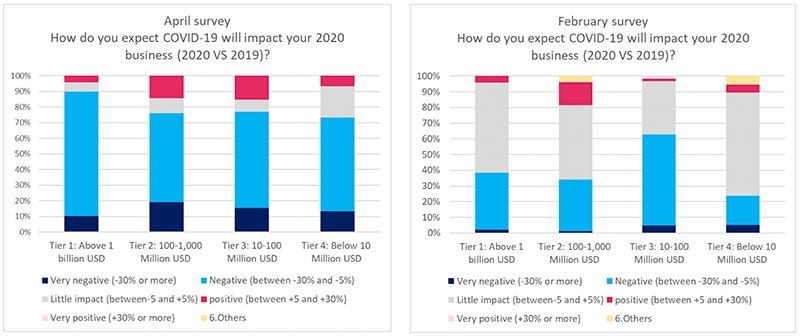

a. By business size

- In the April survey, majority (>70%) of the respondents foresee negative impact (very negative and negative) on their 2020 business, strongest impact is expected by respondents from Tier 1 companies.

- Tier 1 and Tier 4 companies: proportion of respondents who expect negative impact increase the most, compared with the result of the February survey.

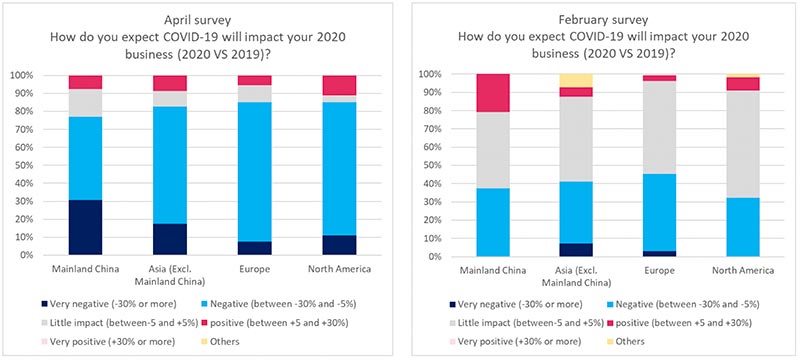

b. By location of HQ

- Negative impact is commonly expected by companies headquartered in different regions, in which, proportion of respondents expecting very negative impact is highest for Mainland Chinese companies.

- Compared to the February survey, the proportion of respondents in North America expecting negative impact has increased the most (more than doubled) between February and April survey.

There is only 1 company headquartered at Africa in April survey, so it is not included in statistics to avoid bias

c. By end-use market

- In the April survey, proportion of respondents expecting negative impact (very negative and negative) on their business in 2020 averagely increase 50%, compared with the results in the February survey.

- Proportion of respondents holding negative attitude occupy 75-100% share in the April survey, while in the February survey, this proportion was mostly in the range of 20-50%. Compared with the survey ran in February, in April, proportion of respondents expecting negative impact

- Increase the most in: Packaging(*), followed by Other Transportation (Aerospace, Marine, Mass Transit etc.)

- Increase the least in: Medical Devices & Pharmaceutical, followed by Home & Personal Care

(*) in this study, the questions asked and their answers concern the Packaging, namely all types of packaging and the situations and trends may be different sub-segment by sub-segment (for example for food packaging ) but this cannot be shown in this study.

- Proportion of respondents foreseeing very negative impact increased in the April survey

- Proportion of respondents holding negative attitude occupy 75-100% share in the April survey, while in the February survey, this proportion was mostly in the range of 20-50%. Compared with the survey ran in February, in April, proportion of respondents expecting negative impact

- For investigated companies targeting Food & Nutrition, proportion of respondents expecting little impact and positive impact is larger than that in other end-use market in both February and April survey

6. Short-term actions and long-term strategy to fight COVID-19

a. Short-term actions

In the short-term, a majority of the companies chose to limit business trips and rely as much as possible on remote work/meetings.

More than 60% respondents choose to freeze non-essential costs in the short term to relieve the operation pressure of the company when facing the COVID-19 crisis.

(*) Options newly added in April survey

38% of the respondents’ companies have donated or will donate money, materials or products to the hospitals and organizations to help fight the virus.

This percentage is higher for companies that already have relevant products or solutions to help control the spread of COVID-19 and is very close to the results in February survey.

b. Long-term strategies

- Changing HR process & internal communication and modifying EHS process are considered by many respondents as the medium to long term strategies to ensure the labor safety and normal operation of work in the COVID-19 pandemics.

- In the survey ran in February, ~10% respondents considered postponing investment in Mainland China. While, in April, nearly half of the respondents plan to postpone any investment.

- Decreasing demand from the end-use market makes some respondents consider exploring non-markets or new markets.

(*) Options newly-added in April survey

(**) In the survey ran in February, this option was “Postpone investment in Mainland China” considering that COVID-19 mainly emerged in Mainland China at that time. In the April survey, since the geographic scope for the whole survey is global, this option is offered based on a global view

7. Importance level of the questions/problems faced due to the current Coronavirus crisis

The most listed challenges and questions in the 2 surveys:

Labor safety is the most important issue highlighted by respondents in the April survey, followed by cash flow. Restarting the production as soon as possible will help to relieve the cash flow pressure in COVID-19 crisis. How to ensure the safety of the staff at work become a very important thing and a new reality, which makes the companies as well as the government of countries very cautious about the attitude to adopt for production restart.

Logistics and uncertainty of the future economy are still listed among the TOP concerned issues in the April survey.

8. Conclusion

As the COVID-19 has kept spreading throughout the countries and regions in the past 3 months, Respondents commonly show more concerns and negative impact of COVID-19 on their business in the April 2020 survey. Compared with the result of the February survey, proportion of respondents expecting negative impact mostly increased:

- By business size: companies with business size above 1 billion USD

- By location of HQ: North America & Europe

- By end-use market: Packaging and Other Transportation (Aerospace, Marine, Mass Transit etc.)

Respondents’ companies with customers in Food & Nutrition, Medical Devices & Pharmaceutic, Energy (Bio-Based & Conventional), Home & Personal Care and Industrial process show more positive attitude on the impact of COVID-19 on their 2020 business.

Unlike the situation in February 2020 (Survey #1), COVID-19 is now all over the world and the Virus spread increases the uncertainties about the future trends of global & regional economy, domestic & international Supply Chain and demands of end-use markets. Therefore, when the production of the companies recovers full capacity or when the countries recover still remain unknown for most of the respondents.

Labor safety is the most important issue concerned by the respondents, companies have taken both short- and long-term actions (stop non-urgent business trip, use remote work tools and process, modify EHS processes etc.) to reduce the risks for infection.

Cash flow is the issue with importance second to labor safety concerned by the respondents.

When facing with the global COVID-19 crisis, most of the respondents’ companies are already thinking about longer term strategy modifications in all aspects (HR, investment, New Business Development, Production Footprint, EHS etc.) to increase their capability and mitigation program.

About Daydream:

Daydream-Dynovel is a Business Consulting firm for B2B Market Strategy & New Business Development of Chemical industries, that has successfully assisted in overcoming internal & external challenges and quick adaptations in this new economic context in Europe, Asia and North America.

Our next publication will be published in June 2020 with a complete Benchmark of the TOP Chemical Companies with a Specific Focus on R&D, Patents and operations footprint.

Please check more details by clicking: www.daydream.eu or contact us contact@daydream.eu